Summary

Despite growing public concern about the cost of college, higher education is still the best investment a young person can make. The American public understands that college is both increasingly necessary and increasingly unaffordable. This dynamic explains the growing public conversation around the idea of “free college”.

This policy brief discusses the economics of free college. An important cause of current levels of economic inequality is growing demand for college-level skills that began in the 1980s, combined with slow growth in the number of young people receiving degrees. A high-quality college education teaches critical thinking and abstract problem-solving, and also helps students think seriously about values and ethics. Technological change will make these skills more valuable than ever. Thus expanding access to higher education is an urgent national priority.

The short-run cost of expanding access to higher education is potentially large. Yet the long-run cost is much smaller. This is because education is an investment that requires up-front spending, but pays back benefits over time. Policies that increase college attainment can pay for themselves – or even yield net benefits to the taxpayer – because college-goers earn more after graduation and pay higher taxes.

All this means that free college policies should be designed to achieve the goal of universal college completion. Free college is a means to an end. A policy that pushes the U.S. toward universal college completion would pay for itself many times over.

Not all free college plans are well-designed to achieve this goal. In fact, a poorly designed free college plan could make the problem worse. For example, free tuition would do little to solve another important problem in higher education – low rates of degree completion. Lower prices do nothing to help overcrowded and underfunded public institutions.

A major concern is that states lowering tuition to zero will balance their budgets by cutting spending. Research suggests that this would lower graduation rates, making the completion problem worse. Thus the right path is a “grand bargain” that greatly increases funding in public postsecondary institutions, while also holding them accountable for graduation rates and labor market outcomes.

As I discuss below, one promising idea is a Federal matching grant. This would provide Federal funds to public institutions in states that commit to making college tuition-free.

Introduction

American higher education is facing a crisis of public legitimacy, and rising college costs are a key reason. The price of a four-year college education has risen faster than inflation for thirty consecutive years. A 2018 Pew survey found that 61 percent of US adults now think that “higher education is going in the wrong direction”. Of those, 84 percent identified rising tuition prices as a reason, higher than any other explanation by far.

Yet despite the growing economic burden of paying for college, attendance rates have continued to rise. This is because – despite all its faults – a college education is one of the best investments a young person can make. The economic return to a college degree is still near an all-time high of around 14 percent per year – double the long-term return on stocks. While student loan burdens are growing rapidly, debt is still low relative to the long-run economic payoff of a college degree (motivating some economists to call for a stronger income-based repayment system).

One reason college pays off is that the bottom has dropped out of earnings for the less-educated. In fact, rising economic inequality over the last several decades closely tracks the rising return to education. Since 1980, inflation-adjusted weekly earnings for US college graduates have grown by about 35 percent. In contrast, real wages have declined for workers with only a high school education. This basic pattern of widening earnings gaps by education holds for both men and women, for all racial groups, for immigrants as well as natives, and in nearly all countries in the developed world.

Popular attention has focused on wealth concentration among the “top 1 percent” as a source of rising inequality. Others have focused on globalization and the rise of multinational corporations. Yet few understand just how important education has been in contributing to rising inequality among the “other 99 percent”. The inflation-adjusted earnings gap between two-earner households with a high school education and a college education grew by about $28,000 between 1979 and 2012. This increase is four times larger than the redistribution of income that has occurred from the bottom 99 percent to the top 1 percent over the same period.

Looking beyond earnings, all of today’s most pressing social problems – from declining male labor force participation to falling marriage rates and increases in single parenthood to rising mortality and opioid addiction – disproportionately afflict people without college degrees.

The American public understands that college is both increasingly necessary and increasingly unaffordable. This dynamic has rapidly increased political support for “free college” plans. Eleven states have passed or pending “free college” legislation as of early 2019. Dozens of cities – ranging from Kalamazoo to Pittsburgh to New Haven – have enacted “college promise” programs, which offer free college tuition to students attending city public high schools. While most free college plans are restricted to community colleges and to full-time, traditional students, some states such as New York and Tennessee have expanded “college promise” plans to the four-year sector and to adult students. President Barack Obama proposed a national free college program in 2015, and this year Democratic presidential candidates such as Bernie Sanders, Elizabeth Warren and Joe Biden have followed with plans of their own.

The Economic Case for Investment in Higher Education

Economists primarily think of education as “human capital”. Obtaining more education is like digging a hole with a bulldozer rather than a shovel. More education allows one to get more done in the same amount of time, increasing productivity and thus market wages.

Some economists argue that education doesn’t actually increase productivity – rather, it is a signaling mechanism that provides employers with information about your ability. However, the best evidence suggests that most of the economic return to education is human capital. A number of papers find that increases in the quantity and quality of schooling boost earnings, even when these increases are not observed by employers. One example is compulsory schooling reforms. In studies such as Angrist and Krueger (1991), Meghir and Palme (2005), Oreopoulos (2006) and Aryal, Bhuller and Lange (2019), young people are legally required to stay in school longer, and this increases their earnings years later even when it does not lead to increases in degree attainment. Another example comes from Arteaga (2018), who finds that a reduction in coursework requirements for economics and business degrees at a university in Colombia reduced wages. Since employers were not aware of this curricular reform and it did not affect selection into university or graduation rates, the earnings losses are almost certainly due to learning losses. Overall, there is strong evidence that education increases productivity directly.

Another important benefit of education is that it helps you “learn how to learn”, a skill that is especially helpful in times of rapid change. There is a wealth of historical evidence suggesting that education helps workers learn new technologies. The Industrial Revolutions in 19th century England and early 20th century America were fueled by rapid increases in formal schooling in both populations. New industrial processes were made possible by the diffusion of electricity, and they required workers with basic literacy and numeracy skills who could decode manuals and blueprints, solve formulas and communicate with highly skilled professionals. Educated farmers are more likely to adopt new technologies.

The information age – often dated to the introduction of the IBM-PC in 1981 – has also changed the labor market in ways that favor the highly skilled. Computers specialize in information processing and categorization tasks that were formerly the domain of payroll clerks, typists and other middle class workers. While computers replace humans in routine information processing tasks, the value of workers who use this information to make decisions and solve problems has dramatically increased.

Recent developments such as machine learning (ML) methods can be understood as a continuation of this trend. ML and Artificial Intelligence techniques use information to make predictions. Better predictions can be used to make better decisions and set priorities, but that requires an understanding of the technology and its limitations. A high-quality college education teaches critical thinking and abstract problem-solving, and also helps students think seriously about values and ethics. Technological change will make these skills more valuable than ever.

Other countries understand this, and have invested much more than the US in higher education. 41 percent of the baby boomer generation in the US (those ages 55-64 in 2014) has completed some tertiary education. This ranks 3rd among OECD countries, behind only Israel and Canada. However, tertiary education rates have increased only 5 percentage points – to 46 percent – for young people age 25-34. In contrast, the average growth rate among other OECD nations over the same period was 16 percentage points. The US has fallen from 3rd to 10th among OECD nations in the last 30 years, and its tertiary education growth rate of 5 percentage points ranks 32nd out of 35 countries.

Common Objections

Why should the government fund students to attend college?

If college is such a good investment, why don’t students finance a college education out of their own pockets? There are three broad reasons for the government to subsidize higher education. First, students and their families may not be able to afford college. In other private markets, the solution is to offer a loan where the item itself (e.g. a house, or a car) becomes collateral in the event of default. Unlike a house, investments in education have no obvious source of collateral since students cannot contractually commit to pay their future wages. Thus private lenders are reluctant to offer unsecured loans. This is why educational loans in the U.S. and many other countries are mostly offered (or at least guaranteed) by the government. Borrowing constraints have become quite important in the U.S. in recent years, and can affect the quality of school attended as well as the quantity (Lochner and Monge-Naranjo 2012, Sun and Yannelis 2016).

A second reason for government involvement is a lack of information about the costs and benefits of investment in higher education. Survey data consistently show that college-age youth and their parents are misinformed about the average returns to a college degree and to specific college majors (Betts 1996, Avery and Kane 2004, Grodsky and Jones 2007, Hoxby and Turner 2015, Wiswall and Zafar 2015). Students are unlikely to know with certainty whether college will benefit them until long after the investment decision is made. Thus risk aversion and misperceptions about the returns to education may prevent some youth from attending college.

A final reason for government intervention in higher education is that the benefits of a more educated populace are widely shared. Education increases civic participation and decreases crime, both of which have spillover impacts on one’s fellow citizens. Workers earn more when they live in cities with more college-educated workers, and employers that locate in these cities are more productive (Moretti 2004). A recent historical study found that increasing the number of universities in a country led to higher GDP growth (Valero and Van Reenen 2016).

What would happen if we expanded access to higher education? Wouldn’t the least-prepared students struggle to succeed?

The market for higher education may fail to work well on its own for a number of reasons. However, even if we solved the market failures described above, the impact of expanding college access might still be small. While many studies show that the average return to college is high, the return to college for marginal students could be lower. Cameron and Heckman (2001) estimate a structural model of educational choice and find that long-run factors such as family environment are more important than financial constraints in determining college attainment. Their results – and similar findings reviewed in Lochner and Monge-Naranjo (2012) – imply that the return to college for marginal students is low.

However, a number of recent quasi-experimental studies reach the opposite conclusion. Zimmerman (2014) compares applicants on either side of a test score cutoff for admission to a Florida public university. About a decade after high school completion, students who are barely admitted earn 22 percent more than those who are barely denied. Importantly, most of the students who are denied admission end up attending a local community college. Several other studies find high economic returns for students whose test scores barely exceed an admissions cutoff (Hoekstra 2009, Anelli 2018, Canaan and Mouganie 2018, Ost, Pan and Webber 2018).

This evidence is important because it answers an important policy question – “what would happen if we expanded the number of seats at a moderately selective public university?” Admissions cutoffs are designed with capacity constraints in mind. An obvious policy implication is that admitting more students by lowering the threshold for academic preparation would yield higher returns for marginal students – the opposite of what earlier research predicts.

Can we afford it?

The country has many competing priorities, and it could be very expensive for cash-strapped governments to increase higher education subsidies. However, a growing body of evidence suggests that well-targeted education spending can pay for itself and actually yield net benefits to citizens in the long-run. The reason is that education – unlike many transfer and social assistance programs – is an investment that yields returns later in life. Education seems expensive, because the costs are easy to measure and are paid up-front. The benefits of education, while large, are long-run and diffuse.

Using a discontinuous change in the Pell Grant funding formula, Denning, Marx and Turner (2019) find that financial aid significantly increases degree completion and postgraduate earnings for students beginning at a four-year public university in Texas. They estimate that a cumulative increase in financial aid of about $1,100 increases earnings by about $3,800 seven years after grant receipt. This increase in earnings leads to an increase in tax payments – which economists call a fiscal externality. According to the authors’ calculations, the fiscal externality impact of increasing college attainment through financial aid allows the government to completely recover its costs within 10 years and likely pays for itself many times over.

Most policy choices involve tradeoffs of some kind. Hendren and Sprung-Keyser (2019) conduct a comprehensive analysis of the welfare impacts of nearly 150 U.S. government programs. They use causal estimates of policy changes from existing studies to construct – for each class of policy – a statistic called the Marginal Value of Public Funds (MVPF). The MVPF starts with the value that beneficiaries place on the benefits of the policy, and then divides that value by the cost to the government of providing the benefit. An MVPF of one represents a pure transfer of money from taxpayers to an individual. The MVPF can be less than one if the policy changes behavior in a way that reduces revenue (for example, by causing individuals to work less). Conversely, the MVPF can be greater than one if spending a dollar on a program like financial aid increases earnings potential and thus tax revenues, as in the case of Pell Grant aid.

Hendren and Sprung-Keyser (2019) produce a striking finding – MVPFs are highest for policies that invest in the health or education of low-income children. This includes early childhood education, but also a number of policies that increase access to higher education. In many cases, the MVPF is infinite, which corresponds to the case above, where financial aid fully pays for itself. This is the rare example in economics of a “free lunch”.

In contrast, policies that target adults have MVPFs around 1, meaning they are transfers from taxpayers to different groups of beneficiaries. These transfers might still be desirable (for example, providing health insurance to low-income adults), but they do have tradeoffs.

The key insight is that unlike many other social policies, education is an investment in the future. Rather than asking whether we can afford to expand access to higher education, we should be asking whether we can afford NOT to do it.

Wouldn’t a free college program be regressive, because the wealthy are more likely to attend college?

In a narrow sense, yes. Students from poor families are less likely to attend college at all, and they also attend lower-priced colleges than their wealthier peers. Thus the benefits of free college in terms of lower tuition would be regressive, relative to a policy that distributes dollars equally across families.

Another concern with the design of most free college policies is that they are “last dollar” scholarships, meaning they cover unmet need only after accounting for other sources of financial aid such as the Pell grant. Thus students who qualify for need-based financial aid are often already attending public institutions tuition-free. Chingos (2017) and Baum and Tilsley (2019) calculate that the benefits of free college proposals – in terms of dollars saved – are greater for higher-income families, because they attend higher-priced institutions and do not receive Federal aid.

However, there are three reasons that free college is less regressive than it appears. First, the financing mechanism matters. Any free college plan that is paid for by taxing the rich – as in several of the plans put out by Democratic candidates for President – will probably be progressive. On the other hand, several states such as Georgia, Arkansas and West Virginia have “merit aid” scholarship programs that allow students meeting minimal academic qualifications to attend state universities tuition-free. These scholarships are funded through the state lottery, so they are transfer from lottery ticket purchasers to college-goers and are most likely regressive. The bottom line is that you can make any free college plan progressive or regressive depending on how you pay for it.

Second, the calculation of who benefits from tuition reduction assumes that that the population of college-goers stays fixed. But the goal of free college plans is to increase college attendance and completion, especially for poor students. If that were to happen, the impact of free college would become much more progressive. Wealthier students are already mostly going to college, and so free college might shift them from the private sector to the public sector. They would save a lot of money on tuition, but in either state of the world they would get a college education.

However, making college free could shift many more poor students into college in the first place. In that case, they wouldn’t save any money on tuition (it would be zero in both cases), but they would have much higher lifetime earnings. Since the value of even a small increase in lifetime earnings is much higher than the value of a few years of lower tuition, behavioral impacts of free college policies would likely make them much more progressive.

Third, part of the argument for free college is about the political economy of universal programs. Proponents rightly argue that programs such as Social Security and Medicare have had more staying power precisely because they are available to everyone. In a broader sense, judgments about a program’s progressivity are always relative to the status quo. One could imagine that the same argument was made about high school in the US 100 years ago, before we decided to publicly fund and universally provide K-12 education.

Design Principles for Free College Plans

Expanding college access could yield large economic benefits, both for individual students and for society. Moreover, such an expansion is unlikely to happen through individual action only – government intervention is necessary. Perhaps most importantly, policies that increase college attainment would be affordable in the short-term, and pay for themselves in the long-term.

Design Principle #1 – Increase college access

The ultimate goal of any free college policy should be to increase the number of students who complete a four-year college degree. Making college free is a means to an end. It is important to ease the financial burden of students who are already going to attend college. But lowering prices for students who already plan to attend should be secondary to the goal of getting more students through school.

Broadly speaking, the ideal policy should seek to generate the largest amount of educational attainment – including degree completion – per dollar spent. Some free college policies increase attainment by inducing students to go to college who would otherwise not enroll. Others mostly shift students across schools of different types (public vs. private, two-year vs. four-year).

“Merit Aid” is one example of a free college policy that mostly subsidizes inframarginal students. Merit aid programs offer free or reduced in-state tuition to students meeting broad eligibility criteria, including academic qualifications. Several studies have found small positive impacts of merit aid on initial enrollment, but weaker and inconsistent impacts on college completion (Dynarski 2000, Fitzpatrick and Jones 2012, Sjoquist and Winters 2012, Cohodes and Goodman 2014, Scott-Clayton and Zafar 2016). One reason is that most students who receive merit aid are already planning to attend college, and so the net impacts on college attainment are relatively small. Fitzpatrick and Jones (2012) argue that “nearly all of the spending on these programs is transferred to individuals who do not alter educational or migration behavior.”

The free college programs in most states apply only to the two-year sector. One concern with community college “promise” programs in states like Oregon and Tennessee is that students will be diverted away from higher-quality four-year colleges. Carruthers, Fox and Jepsen (2018) find that a pilot version of the Tennessee Promise program in Knox County, Tennessee increased associate’s degree attainment by about 10 percentage points while decreasing bachelor’s degree attainment by 6 percentage points. Given the large difference in mean earnings between AA and BA degree holders, the net impact of the policy on earnings is ambiguous.

The important point is that focusing on particular sectors or colleges subsidizes switching based on relative prices. A statewide – or nationwide – plan would lead to fewer distortions of this type.

How can we design free college policies so that they increase attendance? One way is to focus on underserved populations, and on students with fewer outside options. This includes students from rural areas and first generation college students.

Design Principle #2 – Focus on the supply side

The impact of any free college policy should not just be measured in terms of increased attendance, but also persistence and degree completion. College completion rates are relatively low in the US, especially for low-income students. In a cohort born between 1979 and 1982, only 9 percent of youth from the bottom quartile of the family income distribution completed a four-year college degree, compared to 54 percent of youth in the top family income quartile (Bailey and Dynarski 2012).

Increasing college completion rates will require more than just free tuition. Scholarships and tuition reduction address the financial burden of college attendance, but they do not directly increase the quality of the educational experience. In fact, lowering prices dramatically without allocating additional resources to colleges receiving an influx of students could lower college quality, perhaps substantially.

A larger concern with free college plans is that states will make college free by making it cheap – lowering the price to zero, but spending very little on the educational experience itself. For this reason, free college policies should provide tuition support as part of a broader package of reforms that directly address the funding and governance of public institutions.

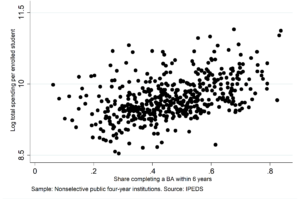

Rates of degree completion are strongly correlated with per-student spending. Figure 1 shows the strong correlation between per-student spending and bachelor’s degree completion within six years, among less-selective four-year public institutions.[1] Recent research shows that students who attend colleges with higher rates of per-pupil spending are more likely to graduate (e.g. Cohodes and Goodman 2014, Goodman, Hurwitz and Smith 2017).

Figure 1: Bachelor‘s Degree Completion and Per-Student Spending.

There is also strong evidence that declines in college quality within institutions over time have led to lower rates of college completion. Degree attainment is lower – and takes longer – when states have larger cohorts of college students, suggesting that lower public subsidies per student negatively affect completion rates as well as time to degree (Bound and Turner 2006, Bound, Lovenheim and Turner 2012).

A few papers hone in specifically on the role of resources in college attainment. Bound, Lovenheim and Turner (2010) show that declines in resources per student – rather than changes in the academic preparation of students – have led to declining completion rates over time. Deming and Walters (2018) study the causal impact of changes in state appropriations on student enrollment and degree completion. They find that state higher education budget cuts have a large impact on postsecondary attainment.

Increased spending can boost degree completion if the money is wisely spent. Contrary to popular perception, most students attend public colleges and universities that are minimally selective and close to home. These schools are heavily reliant on state funding, which has declined markedly in recent years. The quality of students’ educational experiences reflects this belt-tightening. Due to budgetary restrictions, less-selective public institutions often have large classes and provide little in the way of academic counseling, mentoring and other student supports.

Programs that provide counseling, tutoring and other supports to students entering college have large impacts on persistence and degree completion (Angrist, Lang and Oreopoulos 2009, Carrell and Sacerdote 2017, Barrow et al 2014, Bettinger and Baker 2014, Scrivener et al 2015, Page, Castleman and Sahadewo 2016, Clotlfelter, Hemelt and Ladd 2018). One program – the CUNY Accelerated Study in Associate’s Program (ASAP) nearly doubled graduation rates by providing comprehensive academic and support service to students entering community colleges (Scrivener et al 2015).

The success of student support interventions is not surprising, because they essentially replicate the services provided by better-resourced colleges.

Design Principle #3 –Federal funding should flow directly to institutions, but with strings attached

Historically, public universities have been funded primarily through state legislative appropriations that are distributed directly to institutions. State and local funding allows public colleges and universities to provide education at a sticker price that is much lower than its true cost. In 1990, inflation-adjusted net tuition per student was $2,896 in public institutions, yet educational revenue per student totaled $11,583 (SHEEO, 2016). Nearly all U.S. public postsecondary institutions spend more – sometimes much more – per student than they charge in tuition. This “subsidy” allows colleges to provide a higher quality education at a lower price. This could be in the form of smaller classes, more qualified instructors, or additional tutoring and counseling services. When students receive a larger subsidy, they are getting a better deal.

Even though tuition prices have risen steadily, per-student state funding has declined. This means that students are paying higher prices, but getting a worse deal. In 1990, the subsidy in public institutions was $7.26 for every $1 paid in tuition. By 2014, that figure had fallen to $3.87 (Deming 2017).

State support for higher education is in long-term structural decline. However, the Federal role in higher education is growing. Unlike state money, Federal funding mostly flows directly to students. The Pell Grant, for example, is a voucher that gives low-income students a discount to attend a college of their choice. Subsidized loans and tax credits operate in the same way.

Price subsidies lower student costs, but have at least two problems. First, they do not address quality directly. In fact, price subsidies can create strong incentives for state institutions to spend less. For example, consider a public institution that is currently charging $5,000 per year in tuition and providing an additional $10,000 subsidy, for a total of $15,000 of per-student spending. Suppose that student receive a price subsidy in the form of a $2,000 financial aid grant, changing their net price to $3,000.

How do colleges respond to increases in financial aid? One way is by increasing tuition to capture some of the aid – this possibility was famously raised by former Secretary of Education William Bennett as a reason for rising college costs. However, tuition prices are very visible – both to the public and to state legislatures – and colleges are under a lot of pressure to keep prices low. An easier way to capture some of the increase in Federal dollars is to lower per-student subsidies, keeping tuition constant. In the example above, a college could still charge $5,000 in tuition, of which $3,000 is paid by the student, but could then save money by lowering per-student spending (say to $9,000). Concretely, this would mean laying off faculty (or not hiring replacements), replacing tenure line faculty with adjuncts, increasing class sizes, or increasing guidance counselor caseloads.

Free college programs – if poorly designed – could make this “race to the bottom” in spending worse. Requiring colleges to be tuition free eliminates one margin of adjustment. When state budgets get cut, all of the cut must happen on the spending side. In the example above, asking colleges to lower tuition from $5,000 to $0 without providing any additional resources would force them to balance their budgets by cutting per-student spending from $15,000 to $10,000. Many free college proposals provide additional resources for exactly this reason.

The second problem with price subsidies is that they are hard to embed into a system of accountability. Existing Federal regulations hold out eligibility to distribute Title IV financial aid (Pell Grants and Stafford Loans) as the main threat for violating performance standards. Withholding Title IV funds is effectively a death sentence for most colleges, and so sanctions are infrequently used. When money flows directly to institutions, performance standards can be much more flexible. For example, many states provide extra funding to colleges that meet benchmarks related to student graduation rates or postgraduate earnings.

The idea behind Pell Grants and other demand-side subsidies is that accountability is provided by the market. Colleges are supposed to compete for students – and thus funding – by improving quality. Yet the market for higher education is not very competitive. Most students attend nonselective public colleges that are very close to home and have few competitors. Elite colleges – which compete fiercely within a nationwide pool for the very best students – are an exception. But very few students attend these schools.

A clear example of the failure of market discipline in higher education is the rise of for-profit colleges. In principle, for-profit colleges can increase competition in higher education by responding nimbly to changing employer demands and better serving student needs. In practice, the for-profit sector has been overtaken by large, publicly-traded corporations who game the Federal financial aid system by socializing losses and privatizing profits. In 2012, the 23 largest for-profit colleges enrolled more than 1.1 million students and accounted for 20 percent of the growth in bachelor’s degrees over the previous decades. These programs charge very high tuition, enroll students almost exclusively online, and students who attend them have extremely poor postgraduate labor market outcomes (Deming et al 2016, Cellini and Turner 2019).

The term “for profit” disguises the fact that these institutions are almost entirely dependent on taxpayer funds for survival. Federal Title IV grants and loans accounted for 71 percent of revenue at for-profit colleges in the 2016-2017 academic year. And these figures understate the important of Federal student aid to for-profits, because they do not include military benefits such as the post-9/11 GI bill. A Federal regulation capping Title IV funds at 90 percent of revenue for for-profits (the 90/10 rule) prevents their revenue share in taxpayer funds from being even higher.

The point is that price subsidies have not introduced market discipline into higher education. If we want to increase college attainment, we must greatly increasing spending levels – and quality – in public colleges and universities across America. This will require more resources, but also careful government regulation of the institutions receiving funds.

A Federal Matching Grant for States that Implement Free College

In a 2017 paper, I proposed a Federal matching grant for public institutions in states that implement “free college” proposals. The plan calls for a Federal match on the first $5,000 of net per-student spending in all public postsecondary institutions that commit to making college tuition-free. This means that the Federal government would pay public postsecondary institutions $1 (or more, some plans propose $2) for every $1 in state spending per full-time student, after subtracting any revenue from tuition and fees obtained from ineligible students. Cost estimates for the program range widely depending on the number of states that commit to making college tuition-free. Yet even if the program were adopted in all 50 states, the cost would be no more than one-third of current spending on Federal financial aid programs.

The purpose of a Federal matching grant is to increase the return on state investment in higher education, while also reigning in costs. The matching grant would be restricted to the core spending categories of instruction and academic support, and would also include a rule that restricts the growth of administrative spending to pre-program levels.

Unlike “last dollar” free college proposals, the design of this matching grant would disproportionately benefit low-income students. This is true because of the strong correlation between parental income and college selectivity (e.g. Carnevale and Stroh 2010, Greenstone, Looney, Patashnik and Yu 2013). Highly selective institutions already have high rates of per-student spending, and they disproportionately enroll wealthier students. Matching the first $5,000 would matter most for less-selective public institutions with low current levels of spending. Another big benefit of a Federal matching grant comes through fiscal stabilization. As the largest source of discretionary spending, higher education is often referred to as the “balance wheel” of state budgets (Delaney and Doyle 2011). The existence of a Federal matching grant would blunt legislators’ incentives to enact deep budget cuts to higher education during recessions.

This matching grant proposal share some common features with other plans released by Democratic members of Congress and candidates for President. Bernie Sanders’ proposed College for All Act would eliminate undergraduate tuition at four-year public institutions by providing two-thirds of the funds required to bring every school’s tuition from its current level down to zero. Elizabeth Warren recently released a plan that would make all public institutions tuition-free and would expand Pell Grant funding to cover the cost of college attendance (including housing, transportation and other expenses)

Closest to my proposal, Senator Brian Schatz (D-HI) and Representative Mark Pocan (D-WI) introduced a bill with 40 co-sponsors called the Debt Free College Act. This bill would establish a dollar-for-dollar Federal match to higher education appropriations in states that commit to helping students pay for the full cost of attendance without having to take on any debt. Finally, Senator Chris Murphy (D-CT) recently released a plan for Higher Education Act (HEA) reauthorization that focused on holding schools accountable for graduation rates and other outcomes.

While the design details can vary, a successful free college plan should have many of the features described above. This includes reaching students who would otherwise not attend college at all, a focus on completion as well as access, careful attention to increasing funding and quality in public institutions, and prudent regulation of colleges that receive Federal and state funds.

Endnotes

[1] Figure 1 presents a scatterplot of the relationship between the natural log of per-student spending and the share of an initial entry cohort in 2008 that completes a bachelor’s degree within 6 years. The sample is restricted to four-year public institutions, excluding the most selective universities (defined as either “Most Competitive” or “Highly Competitive” by the 2009 Barron’s Profile of American Colleges and Universities).

References

Anelli, Massimo. 2018. “Returns to elite university education: a quasi-experimental analysis”, working paper.

Angrist, Joshua D., and Alan B. Keueger. “Does compulsory school attendance affect schooling and earnings?.” The Quarterly Journal of Economics 106.4 (1991): 979-1014.

Angrist, Joshua, Daniel Lang, and Philip Oreopoulos. “Incentives and services for college achievement: Evidence from a randomized trial.” American Economic Journal: Applied Economics 1.1 (2009): 136-163.

Arteaga, Carolina. “The effect of human capital on earnings: Evidence from a reform at Colombia’s top university.” Journal of Public Economics 157 (2018): 212-225.

Aryal, Gaurab, Manudeep Bhuller, and Fabian Lange. Signaling and Employer Learning with Instruments. No. w25885. National Bureau of Economic Research, 2019.

Avery, Christopher, and Thomas J. Kane. “Student perceptions of college opportunities. The Boston COACH program.” College choices: The economics of where to go, when to go, and how to pay for it. University of Chicago Press, 2004. 355-394.

Bailey, Martha J., and Susan M. Dynarski. “Inequality in postsecondary education.” Whither opportunity (2011): 117-132.

Barrow, Lisa, et al. “Paying for performance: The education impacts of a community college scholarship program for low-income adults.” Journal of Labor Economics 32.3 (2014): 563-599.

Bettinger, Eric P., and Rachel B. Baker. “The effects of student coaching: An evaluation of a randomized experiment in student advising.” Educational Evaluation and Policy Analysis 36.1 (2014): 3-19.

Betts, Julian R. “What do students know about wages? Evidence from a survey of undergraduates.” Journal of human resources (1996): 27-56.

Bound, John, and Sarah Turner. “Cohort crowding: How resources affect collegiate attainment.” Journal of public Economics 91.5 (2007): 877-899.

Bound, John, Michael F. Lovenheim, and Sarah Turner. “Increasing time to baccalaureate degree in the United States.” Education Finance and Policy 7.4 (2012): 375-424.

Cameron, Stephen V., and James J. Heckman. “The dynamics of educational attainment for black, hispanic, and white males.” Journal of political Economy 109.3 (2001): 455-499.

Canaan, Serena, and Pierre Mouganie. “Returns to education quality for low-skilled students: Evidence from a discontinuity.” Journal of Labor Economics 36.2 (2018): 395-436.

Carnevale, Anthony P., and Jeff Strohl. “How increasing college access is increasing inequality, and what to do about it.” Rewarding strivers: Helping low-income students succeed in college (2010): 1-231.

Carrell, Scott, and Bruce Sacerdote. “Why do college-going interventions work?.” American Economic Journal: Applied Economics 9.3 (2017): 124-51.

Carruthers, Celeste K., William F. Fox, and Christopher Jepsen. “Promise kept? Free community college and attainment in Tennessee November 2018.” (2018).

Cellini, Stephanie Riegg, and Nicholas Turner. “Gainfully employed? Assessing the employment and earnings of for-profit college students using administrative data.” Journal of Human Resources 54.2 (2019): 342-370.

Chingos, Matthew. 2017. “Who would benefit most from free college?” – https://www.brookings.edu/research/who-would-benefit-most-from-free-college/

Cohodes, Sarah R., and Joshua S. Goodman. “Merit aid, college quality, and college completion: Massachusetts’ Adams scholarship as an in-kind subsidy.” American Economic Journal: Applied Economics 6.4 (2014): 251-285.

Clotfelter, Charles T., Steven W. Hemelt, and Helen F. Ladd. “Multifaceted Aid for Low‐Income Students and College Outcomes: Evidence from North Carolina.” Economic Inquiry, 56.1 (2018): 278-303.

Dale, Stacy Berg, and Alan B. Krueger. “Estimating the payoff to attending a more selective college: An application of selection on observables and unobservables.” The Quarterly Journal of Economics 117.4 (2002): 1491-1527.

Delaney, Jennifer A., and William R. Doyle. “State spending on higher education: Testing the balance wheel over time.” Journal of Education Finance 36.4 (2011): 343-368.

Deming, David. “Increasing College Completion with a Federal Higher Education Matching Grant,” The Hamilton Project Policy Proposal, April 2017.

Deming, David, and Chris Walters. “The Impacts of Price and Spending Subsidies on US Postsecondary Attainment.” Unpublished working paper (2017).

Deming, David J., et al. “The value of postsecondary credentials in the labor market: An experimental study.” American Economic Review 106.3 (2016): 778-806.

Denning, Jeffrey T., Benjamin M. Marx, and Lesley J. Turner. ProPelled: The effects of grants on graduation, earnings, and welfare. No. w23860. National Bureau of Economic Research, 2017.

Dynarski, Susan. “Hope for whom? Financial aid for the middle class and its impact on college attendance.” National Tax Journal 53.3 (2000): 629.

Fitzpatrick, Maria D., and Damon Jones. Higher education, merit-based scholarships and post-baccalaureate migration. No. w18530. National Bureau of Economic Research, 2012.

Goodman, Joshua, Michael Hurwitz, and Jonathan Smith. “Access to 4-year public colleges and degree completion.” Journal of Labor Economics 35.3 (2017): 829-867.

Greenstone, Michael, et al. “Thirteen economic facts about social mobility and the role of education.” The Hamilton Project, Brookings Institution, Washington DC. Available at http://www.hamiltonproject.org/papers/thirteen_economic_ facts_social_mobility_education (2013).

Grodsky, Eric, and Melanie T. Jones. “Real and imagined barriers to college entry: Perceptions of cost.” Social Science Research 36.2 (2007): 745-766.

Hendren, Nathaniel and Benjamin Sprung-Keyser (2019). A Unified Welfare Analysis of Government Policies. Working paper.

Hoekstra, Mark. “The effect of attending the flagship state university on earnings: A discontinuity-based approach.” The Review of Economics and Statistics 91.4 (2009): 717-724.

Hoxby (2016) – http://www.nber.org/feldstein_lecture_2016/feldsteinlecture_2016.html

Hoxby, Caroline M., and Sarah Turner. “What high-achieving low-income students know about college.” The American Economic Review 105.5 (2015): 514-517.

Kane, Thomas J., et al. “Higher education appropriations and public universities: Role of Medicaid and the business cycle [with comments].” Brookings-Wharton papers on urban affairs (2005): 99-146.

Levin, Henry M., Emma Garcia, and James Morgan. “Cost-Effectiveness of Accelerated Study in Associate Programs (ASAP) of the City University of New York (CUNY).” Center for Benefit-Cost Studies of Education, Columbia University Teachers College. Retrieved from https://static1.squarespace.com/static/583b86882e69cfc61c6c26dc/t/590b30a959cc68c870520718/1493905580311/Levin-ASAP-Cost-Effectiveness-Report_092412_FINAL-5.pdf (2012).

Lochner, Lance, and Alexander Monge-Naranjo. “Credit constraints in education.” Annu. Rev. Econ. 4.1 (2012): 225-256.

Meghir, Costas, and Mårten Palme. “Educational reform, ability, and family background.” American Economic Review95.1 (2005): 414-424.

Moretti, Enrico. “Human capital externalities in cities.” Handbook of regional and urban economics 4 (2004): 2243-2291.

Mountjoy, Jack. “Community colleges and upward mobility.” Available at SSRN 3373801 (2019).

Oreopoulos, Philip. “Estimating average and local average treatment effects of education when compulsory schooling laws really matter.” American Economic Review 96.1 (2006): 152-175.

Ost, Ben, Weixiang Pan, and Douglas Webber. “The returns to college persistence for marginal students: Regression discontinuity evidence from university dismissal policies.” Journal of Labor Economics 36.3 (2018): 779-805.

Page, Lindsay C., Benjamin Castleman, and Gumilang Aryo Sahadewo. “More than Dollars for Scholars: The Impact of the Dell Scholars Program on College Access, Persistence and Degree Attainment.” (2016).

Scott-Clayton, Judith, and Basit Zafar. Financial aid, debt management, and socioeconomic outcomes: post-college effects of merit-based aid. No. w22574. National Bureau of Economic Research, 2016.

Scrivener, Susan, et al. “Doubling graduation rates: Three-year effects of CUNY’s Accelerated Study in Associate Programs (ASAP) for developmental education students.” (2015).

SHEEO, 2016 – https://sheeoorg.wpengine.com/wp-content/uploads/2019/03/SHEF_FY16.pdf

Sjoquist, David L., and John V. Winters. The Effects of HOPE on Post-Schooling Retention in the Georgia Workforce. Mimeo, 2012.

Sun, Stephen Teng, and Constantine Yannelis. “Credit Constraints and Demand for Higher Education: Evidence from Financial Deregulation.” Review of Economics and Statistics 98.1 (2016): 12-24.

Valero, Anna, and John Van Reenen. The economic impact of universities: Evidence from across the globe. No. w22501. National Bureau of Economic Research, 2016.

Wiswall, Matthew, and Basit Zafar. “Determinants of college major choice: Identification using an information experiment.” The Review of Economic Studies 82.2 (2015): 791-824.

Zimmerman, Seth D. “The returns to college admission for academically marginal students.” Journal of Labor Economics 32.4 (2014): 711-754.