COVID-19 has now reached low-income and middle-income countries.[1] The public health response in many countries has involved strict restrictions on movement and economic activity (e.g. closing workplaces, banning gatherings, restricting travel) and others are considering imposing similar policies.[2] Domestic measures, as well as similar measures adopted globally, are likely to have an immediate negative impact on household incomes, and might threaten the livelihoods of households who are already vulnerable economically.[3] In response, governments are adopting emergency economic measures to provide households with some safety net.[4]

We provide an overview of the policies that could form a comprehensive social protection strategy in developing countries, with examples of specific policies adopted around the developing world in recent days. Our core argument is that middle-income and lower-income countries can cast an emergency safety net with extensive coverage if they use a broader patchwork of solutions than higher-income countries. These strategies could include:

- Expanding their social insurance system, which typically covers a much smaller share of the labour force than in higher-income countries;

- Building on existing social assistance programmes, which reach a large share of households in many developing countries;

- Involving local governments and non-state institutions to identify and assist vulnerable groups who may not be reached by 1) and 2).

The debate on social protection responses occurs as countries face both a public health and a public finance crisis. First, governments have to design a public health response to mitigate or suppress the virus, which balances provision of COVID19 health care against other health needs, and which can be implemented in contexts where strict social distancing is not practical.[5] The strictness and duration of the restrictions imposed on mobility and economic activity will, to a large extent, determine the immediate impact on household incomes, and thus the scale of the social protection response needed to mitigate it. In turn, the support provided to help households could increase compliance with public health policies.[6] Second, governments have to finance both health and economic measures, while experiencing shortfalls in tax revenues. Many developing countries were already heavily indebted before the crisis, and investors have sold emerging market assets, making borrowing on the open market difficult.[7] Without novel solutions to allow governments to borrow internationally and secure additional aid quickly,[8] the scale of their social protection response will be limited, and developing countries may not afford a public health response imposing strict restrictions on their economies.[9]

Key features of developing countries[10]

Low-income and middle-income countries share features that present specific challenges and opportunities for their social protection response, compared to higher-income countries.[11]

- The economic consequences of the crisis for households in developing countries will be severe. A larger share of workers are in occupations and industries less compatible with social distancing (e.g. construction, labour-intensive manufacturing, small retail). Households have more limited access to credit and hold limited savings or buffer stock. Their usual means of smoothing income shocks, casual work and migration, are not possible when economic activity and mobility are restricted. Support from social networks is also more limited when everyone experiences a simultaneous shock, which in the case of a global crisis is true even of the most extended networks (e.g. international remittances). Complying with public health guidelines will incur out-of-pocket costs (e.g. access to water in urban slums) that are high as a portion of available income. In this context, households may take short-term decisions out of necessity that leave them in long-term poverty, such as selling assets to finance food consumption. Moreover, firms often face more severe liquidity constraints in developing countries, limiting their ability to keep paying their workers during the crisis. The need for government intervention is thus particularly severe in developing countries today.

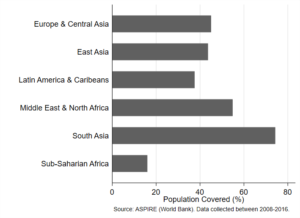

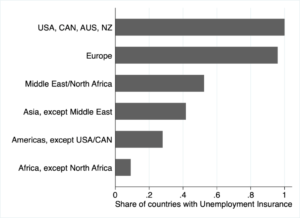

- Yet, government programmes insuring against job or earnings loss have more limited scope in developing countries. First, a larger share of workers are in employment categories that are difficult to insure against such risks. Many employees work for informal (i.e. unregistered) businesses, which may not contribute to existing social insurance programmes, while others work for formal businesses on informal contracts. The self-employed — whose “regular” income is more difficult to assess even in richer countries – account for a larger share of employment, and many of them also carry out their activities informally. Second, government programmes insuring workers against such risks are more limited in developing countries even for formal (i.e. registered) employees. For instance, the share of developing countries in which these workers are eligible for some form of Unemployment Insurance is much lower than in higher-income countries (see Figure 1). Existing social insurance programmes will thus be less effective in supporting workers in developing countries.

Figure 1: Share of countries with unemployment Insurance

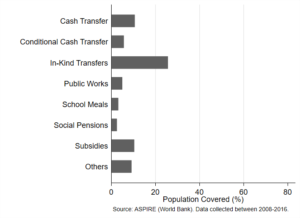

- At the same time, many developing countries can build on large existing social assistance programmes. As Figure 2a shows, these cover a sizable share of the population, including contexts where informal work and self-employment are the norm. These programmes take various forms, such as conditional or unconditional cash transfers, work guarantees, or the direct delivery of food and other necessities (see Figure 2b). They target poor households and are not necessarily designed to mitigate job loss or income shocks. They can be made more generous in this time of crisis. They can also provide a base for emergency assistance, e.g. they often rely on detailed registries and effective infrastructure for transferring resources. Existing social assistance programmes thus provide invaluable mechanisms to provide emergency relief to many households.

Figure 2: Social assistance programs in developing countries

(a) Overall coverage |

(b) Coverage by type of program |

Source: ASPIRE (World Bank); data collected between 2008-2016 http://datatopics.worldbank.org/aspire/

- Some vulnerable populations are not easily covered by social insurance and are usually outside the populations targeted by social assistance programmes (e.g. informal workers with volatile incomes, migrant workers), making them particularly hard to reach in an emergency. However, local governments in many developing countries are in a good position to assess unmet needs and to deliver direct assistance. The same is true of a range of non-state actors (e.g. NGOs, savings and loan associations, mutual insurance organisations), which are active in contexts where state capacity is limited (e.g. remote rural areas or urban slums). Involving local actors, especially non-state ones, is an opportunity but also a challenge, as their efforts need to be coordinated, and they need to be monitored by both citizens and national governments. Credible partners thus exist for central governments to help “harder-to-reach” segments of the population, as long as their actions are in line with the national effort and are accountable to the public they serve.

Expanding the social insurance system

Despite pervasive informality, formal employees constitute a major employment category in many developing countries, particularly in middle-income countries. Moreover, these workers are possibly even less well prepared than their counterparts in richer countries to cope with the economic impact of the crisis. Therefore, expanding the social insurance system to provide more support to formal employees could be an important pillar of the social protection strategy of developing countries, even if it will not be sufficient to reach all workers (e.g. informal workers).

Governments around the world have adopted new job retention schemes in the last few weeks. Such schemes already existed in some countries (e.g. Germany, Italy), including developing countries (e.g. Brazil), to help firms cope with temporary shocks (e.g. drop in demand, insolvency issues, natural disasters). They provide subsidies for temporary reductions in the number of hours worked, replacing a share of the earnings forgone by the worker due to the hours not worked, over a maximum period of time (a few weeks or months). Their advantage in the current crisis is to avoid the destruction of existing jobs (Giupponi and Landais, 2018), which should be viable again once the public health response is relaxed. Subsidizing these jobs could allow firms to continue to operate, even if at some reduced level, without imposing large pay cuts. Subsidizing the survival of jobs that must be temporarily suspended could also spare workers and firms the costs of finding a new job and replacing the worker, speeding up the economic recovery.

The argument in favor of job retention schemes is strong for developing countries. Without such schemes, many workers will be laid off with no unemployment insurance. Moreover, setting up a new job retention scheme might be logistically easier than setting up an unemployment insurance programme, as governments could use firms as intermediaries to channel the income support to their workers. Job retention schemes are also most valuable in labour markets where search frictions are high. Recent research shows (i) that finding the right workers is a major challenge to firm growth in developing countries (Hardy and McCasland, 2017); (ii) that workers struggle to find formal employment because of difficulties signalling their skills credibly to firms (Abebe et al., 2020, Carranza et al., 2020); (iii) and that displaced formal employees take much longer to find a new formal job than in higher-income countries (Gerard and Gonzaga, 2016). The destruction of existing jobs might thus have severe longer-term impacts on the size and productivity of developing countries’ formal sectors, which are a key policy focus (Levy, 2008).

Some implementation details might be particularly important in developing countries:[12]

- Targeting. In Thailand, a recent job retention scheme covers a fixed share of workers’ monthly earnings;[13] in Morocco, a new programme provides a fixed monthly amount to workers whose job must be temporarily suspended;[14] the amount received under the Brazilian and South African schemes is not fixed but the share of forgone earnings that it replaces is lower for higher-wage workers.[15] Targeting the income support to low-wage workers can help more workers for a given budget and leave more financial resources to help other worker categories. However, it will require higher-wage workers to make relatively larger adjustments and increase the risk that their jobs will not survive the crisis. Additionally, targeting support to low-wage workers may not necessarily target jobs for which search frictions are most important, which may slow down the economic recovery.

- Payment. In contrast to some pre-existing job retention schemes (e.g. in France), the above-mentioned schemes do not rely on firms advancing the payment of the earnings subsidy. Firms in developing countries may not have enough liquidity to make such advances or may not trust the government to reimburse them quickly, disincentivizing participation (see Levinsohn et al., 2014, on an earlier wage subsidy in South Africa).

- Other firm contributions. Job retention schemes sometimes require firms to contribute towards their workers’ compensation beyond the hours actually worked (e.g. for larger firms in the Brazil scheme). This could incentivize firms struggling to stay afloat to lay off their workers rather than to participate in the scheme. More generally, firms face other costs than their payroll and helping them cover these costs might be necessary for existing jobs to survive. Several countries have implemented a range of policies in this regard, such as low-interest loans, rent moratoriums, or tax relief.[16]

Even with a job retention scheme, many workers will likely be laid off and developing countries with unemployment insurance programmes will be in a better place to support these workers. However, it might be important to adjust their programmes, such as by relaxing job search requirements and extending eligibility rules. For instance, in South Africa, workers are usually eligible for one day of unemployment insurance for every six days of employment. In Brazil, many workers must accumulate up to 12 months of employment to become eligible for any benefits. Such rules could leave laid-off workers who have limited job tenure (e.g. less than a year) with little income support throughout this crisis and no other employment options in the short run.

A policy that is more common than unemployment insurance in developing countries are mandatory severance payments that firms must pay to workers at layoff. The insurance value of such lump-sum payments is limited when workers cannot find new jobs quickly. Moreover, firms facing severe reductions in cash-flow might struggle to pay what they owe to their workers and governments may need to provide firms with low-interest loans to fund severance pay obligations. Governments could also consider topping up the severance amount and spreading its payment over time to avoid workers spending it too quickly after layoff (Gerard and Naritomi, 2019).

Another common component of the social insurance system in developing countries are mandatory contributions by firms or workers to forced (illiquid) savings accounts for long-term objectives, e.g. to fund a complementary severance payment at layoff or a complementary pension at retirement. Workers could be allowed to withdraw some amount from these accounts in the current crisis. For instance, the Indian government recently allowed formal workers to withdraw up to three months worth of salary (but no more than 75% of the amount in the account) from their Employee Provident Fund.[17] The benefits for workers from such early withdrawals might greatly exceed their costs, particularly for younger workers who will be able to replenish their forced savings accounts in coming years.

Finally, some countries have considered extending the logic of these social insurance programmes to formal (i.e. registered) self-employed workers. However, it is more challenging to determine (a) their “usual” earnings level prior to the crisis and (b) the reduction in earnings caused by the crisis. These challenges will only be exacerbated in developing countries, as governments likely have less information about these workers’ past or current earnings than in higher-income countries, even for self-employed workers who are formally registered.[18] In this context, developing country governments may be left with fewer options:

- One option is to make unconditional monthly transfers of a fixed amount. For instance, the Auxilio Emergencial in Brazil will provide self-employed workers with a monthly payment of 60% of the minimum wage for the next three months.[19] It might be possible to design a more fine-grained payment scheme, e.g. based on some presumptive income varying across sectors of activity. However, the costs of designing a more complicated scheme might outweigh its benefits if it leads to long delays in disbursements (as in the UK[20]).

- A complementary option is to provide emergency low-interest credit lines for self-employed workers, allowing them to borrow a maximum amount to pay themselves in the coming months. Such policies have been recently implemented in some countries to help small and medium firms pay their workers’ wages throughout the crisis,[21] and could be extended to self-employed workers. Repayment of loans could be made contingent on self-employed workers’ future income or gross revenue crossing above a certain threshold, to mitigate concerns of taking on more debt at this time.

Building on existing social assistance programmes

Social insurance programmes will fail to reach a large share of households in developing countries, in particular those mostly active in the informal sector of the economy. However, many of these households could be reached through social assistance programmes. For example, South Africa’s child support grant reaches many poor households who are in informal jobs and will not be covered by its job retention scheme.[22] Maintaining these programmes throughout the crisis will already provide some minimal support to many affected households, although some of their rules might need to be adapted. These programmes could also be made temporarily more generous to compensate current beneficiaires for income losses. Finally, these programmes could be temporarily extended to new households, e.g. to households whose information was collected to target these programmes, and who were deemed ineligible. In practice, these programmes take many forms and their key features determine how they can be used in response to the crisis.

The first feature is the type of assistance that these programmes provide. Some programmes dispense cash; some provide in-kind assistance (e.g. food, fuel); others subsidize access to essential goods and services (e.g. health services, housing). In cases where supply chains are impacted or prices rise, in-kind provision will be most powerful, and public procurement will support producers as well. For instance, the Indian government doubled the monthly foodgrain (wheat and rice) household allowance and added pulses to the ration provided by the Public Distribution System.[23] When households can buy goods and services at reasonable prices, cash transfers are quicker to implement and more fungible than in-kind transfers. Many countries have temporarily topped up the amount received by the current beneficiaries of social assistance programmes. For instance, the Indonesian government increased both the benefit amounts of its cash transfer programme (PKH) and the frequency of its payments (from quarterly to monthly).[24] Kenya has increased the amount of its pension and orphan and vulnerable children’s grant.[25] Finally, in the case of subsidies, the government can offer free provision or delay payments, especially for utilities that are publicly owned (e.g. electricity bills or rents). Indonesia has recently granted three months of free electricity to 24 million customers with low power connections.

The second feature is the conditionality of the social assistance. Conditional Cash Transfers (CCT) programmes are a popular form of income support in developing countries (e.g. Mexico’s Prospera or Brazil’s Bolsa Familia). They make assistance conditional on a particular behaviour encouraged by the state, e.g. enrolling children at school or immunizing them. Public works programmes are also often used for anti-poverty relief in the developing world (e.g. India’s MG-NREGS or Ethiopia’s PSNP). These conditions cannot be fulfilled at the time when countries have closed schools and public works sites because of safety, or when hospitals are overwhelmed. To provide social protection in the current crisis, CCT and public works programmes need to become temporarily unconditional. Removing conditionalities may be legally or politically difficult. For instance, India’s relief package increases the wage for MG-NREGS workers, but it makes no provision to make public work sites compatible with social distancing. Other public works programmes, such as Ethiopia’s PSNP (Berhane et al., 2015), already provide cash or food for those identified by communities as unable to work and could perhaps extend this feature to all programme recipients.

The third feature of social assistance programmes is the population that they target. Some programmes help specific socio-demographic groups (e.g. non-contributory social pensions for the elderly or grants for orphans and children). Some provide relief to specific occupational groups (e.g. farmer drought relief funds). Others are targeted according to economic indicators, such as transfer to households deemed poor based on their assets (e.g. Indonesia’s conditional cash transfer PKH). Developing countries can leverage all their programmes simultaneously to provide assistance to a wide range of vulnerable groups. Each of these programmes suffers from inclusion errors, with resources being diverted to non-eligible households or stolen by corrupt bureaucrats, and from exclusion errors, with eligible households deterred from applying (Hanna and Olken, 2018). In these times of emergency, governments will have to rely on social assistance programmes, even if their targeting is not perfect. Direct beneficiary payments, and transparency in how much is given to whom, may help keep “fund leakages’’ under control (Muralidharan et al., 2016; Banerjee et al., 2018).

Using existing programmes to extend assistance to new beneficiaries is possible, but requires both information on potential beneficiaries and payment infrastructure to reach them. Some countries have built digital infrastructures linking governments and poor citizens for various programmes that can now be used for emergency payments (see Rutkowski et al., 2020). For example, Chile has a national ID-linked basic account for most poor people, which will be used to pay more than 2 million low-income individuals a once-off grant. India also has sent money to Jan Dhan accounts linked to the Adhaar ID system, which were created to promote financial inclusion among the poor. Other countries have detailed censuses to identify the poorest citizens for social assistance. These censuses can now be used to extend assistance to people who were initially deemed too well-off for assistance. For example, the Peruvian programme Bono Yo Me Quedo en Casa[26] offers an additional transfer equivalent to 50% of the minimum wage to 2.7 million poor households identified in a dataset created to target the Peruvian Juntos CCT. Beneficiaries can check their availability online, and payments are routed via a national bank. In countries in which no pre-existing databases are available, or where governments would not automatically enrol large parts of the population in emergency assistance programmes, they may prefer to ask people in need of assistance to opt in. For instance, Pakistan has announced a relief package with large transfers to the poor, but the emergency programme requires people to self-identify as vulnerable and to text the existing social programme Ehsass with their national identification number.

Enrolling new beneficiaries and paying them is a challenge in many settings. In non-crisis times, enrolling people and checking eligibility may be more effective to target the poorest than automatic enrolment (Atalas et al., 2016). But enrolment systems set up in times of emergency may not necessarily target the most vulnerable efficiently.[27] For instance, the state of Bihar in India has announced a transfer to all migrant workers stranded in other states and plans to perform identity checks through a phone app.[28] Households recorded in the Cadastro Unico — i.e. the Brazilian census of the poor — will be eligible for the same Auxilio Emergencial as formal self-employed workers (see above), but the government also created a new website to extend coverage of this emergency assistance programme to informal workers at large. The use of these technologies may prevent individuals without a computer or smartphone from enrolling, unless complementary systems are set up. Even if they successfully enrol, transferring money to these new beneficiaries can be difficult. Relying on digital payment infrastructures is quicker and safer in an epidemic, but it might exclude particularly vulnerable households: globally, only 69% of adults have any digital bank or mobile money account; only 30% have received wages or government transfer payments directly to an account (Findex, 2017). In this context, it will be necessary to set up physical collection points or direct delivery systems for these households while still respecting social distancing measures. In Peru, bank branches were overcrowded when recipients of the Bono Yo Me Quedo en Casa programme came to cash their benefits.[29]

Involving local governments and non-state institutions

A strategy based on expanding social insurance and building on existing social assistance programmes will likely leave important needs unmet. For instance, informal workers with volatile incomes (especially in urban areas) or with weak ties to their place of residence (e.g. migrant workers) are often beyond the reach of social insurance and usually outside the populations targeted by social assistance. A comprehensive social protection response could involve local governments and a range of non-state actors to collect better information on these unmet needs and to deliver targeted assistance.

State and municipal governments may play a complementary role to national governments, who often have the main mandate for social insurance and assistance. Many developing countries have decentralised extensively over the last decades, and have devolved a range of government functions to lower echelons of government, including responsibilities related to social assistance. For example, the responsibility for implementing India’s employment guarantee MG-NREGS is devolved from the central government to the state, the district, the block, down to the Gram Panchayat, a local government of about 500 households. It is common for developing countries to elect or select a large cadre of leaders at very local levels. In Kenya, each village of ~120-200 households has a volunteer village leader who reports to the lowest level of paid civil servant, the assistant chief, adjudicates disputes and spreads information from the state (Orkin and Walker, 2020, Walker, 2019).

These structures can play multiple roles during this crisis. First, local structures can channel information up to decision-making structures, which is important when travel is limited. Information could be movements of people, price and availability of food, whether new social protection measures have been successfully implemented, and whether specific groups remain unexpectedly not covered. In food-insecure countries like Malawi and Ethiopia, infrastructure has been built to collect local data on food security and channel food or cash to famine-affected areas[30] and public works programmes to food-insecure areas (Berhane et al., 2015, Beegle et al., 2017). Similarly, for public health success against ebola, it was vital that local structures relayed data back to co-ordinating structures for better decisions.[31]

Second, local structures could be involved in the identification of individuals in dire need of additional support. They were often involved in the targeting of social assistance programmes pre-crisis, both in the gathering of information on vulnerable populations for higher levels of government and in the prioritization of assistance to the most needed. For example, censuses of the poor used to target CCT programmes are typically updated by local administrations in Latin American countries. Rwanda is using local structures to target in-kind food security packages, which will complement its existing social protection scheme. Vulnerable households are identified at the most local (isibo) level, with information on numbers of households relayed up to higher government structures.[32] To avoid exclusion errors, the capital city government set up a toll free line for households who reported they missed out in the targeting.[33]

These institutions have particular strengths that may complement a national government response. They may have funding or staff already in place at local level. Local authorities often receive block grant funding to address locally identified needs, with local structures in place to monitor how it is allocated. Funding could be temporarily repurposed or these structures could be used to channel any additional funds granted. For example, the Indian government allowed state governments to use disaster funds to provide shelter and food to migrants workers.[34] Local governments also have networks of employees (e.g. for education, health, welfare) in contact with more remote communities and able to support them in accessing services. For example, South Africa’s network of early childhood community care givers primarily conduct health promotion and prevention activities; pre-crisis, government tapped this network to assist families in enrolling for child support grants (Hatipoğlu et al., 2018).

Local governments often have better information on local needs and preferences, so may be more responsive. As a result, their decisions may have more legitimacy. For example, in Indonesia, leaders allocating cash transfer benefits via community targeting did reasonably well in terms of targeting the poor. Communities were also more satisfied with community targeting than an externally administered proxy means test (Atalas et al., 2012). They may also be more easily held accountable to communities and may feel pressure to be more responsive, provided the resources and functions devolved to them are clearly communicated to the public (Gadenne, 2017, Martinez, 2018). For example, the state government of Bihar (India) has felt pressure to extend its attention to migrants in this crisis, a segment of the population which it does not usually serve or respond to, and which was excluded from the central government relief package. On the other hand, local structures may be more open to capture. For example, after a serious drought in 2002 in Ethiopia, community-based targeting of food transfers was targeted to households with less access to support from relatives or friends but was also twice as likely to be targeted to households with close associates in official positions (Caeyers and Dercon, 2012).

A range of non-state institutions are also particularly active in giving voice to specific groups or serving populations beyond the reach of the state. Depending on the context, these institutions may be in a unique position to gather information on the needs of specific groups, and/or be credible partners for delivering assistance in an emergency.

There are a broad range of examples of such institutions. Illegal urban settlements sometimes have recognized local leaders who facilitate access to state services and social benefits and are accountable to local populations (e.g. in urban India[35]). Recognized local NGOs also often provide a range of services and sometimes coordinate their efforts within a geographic area under an umbrella organization (e.g. in urban Brazil[36]); they may have years of experience being accountable to both their donors and their beneficiaries. International NGOs (e.g. BRAC, Oxfam) have a strong presence across a range of contexts. There are also private associations with specific purposes, which can, in some instances, have wide coverage. For example, 24% of Africans participated in community-organised savings groups (Findex, 2014). Membership may be even higher in rural areas: 53% of a rural Kenyan sample were members of a rotating savings group (ROSCA) (Orkin and Walker, 2020). In Ethiopia, over 90% of villagers in two separate samples are members of burial associations (Dercon et al., 2006; Bernard et al., 2014). Another type of private associations are professional organizations, which may be active in sectors that employ many informal or poor workers. For example, India’s relief package encourages Building and Other Construction Worker Welfare Funds to provide emergency assistance.[37]

These institutions could play a range of roles. Some will likely repurpose themselves to provide emergency assistance in the current crisis spontaneously, an effort that could be leveraged and complemented by governments. Governments could leverage their infrastructure to gather information on the needs of their many beneficiaries. Many have a network of workers in remote areas, who are already part of public health responses, e.g. an NGO trained community volunteers, religious leaders and traditional healers in Senegal to monitor for common diseases in their villages.[38] They could be used to recruit people into government programmes in environments where communication about new programmes is difficult. For instance, Kenya used ROSCAs to enroll participants into its new health insurance scheme (Oraro and Wyss, 2018). India used National Rural Livelihood Missions and their network of Self-Help-Groups (SHG) to advertise and enrol people into many development programmes, such as rural sanitation (Swachh Bharat Mission).

It may be unusual to involve non-state actors directly in provision of state assistance, but unprecedented times may call for exploring new opportunities. Although there may be justifiable concerns about a lack of accountability, institutions with a long history and broad base of membership may be particularly resistant to the capture of transfers (Dercon et al., 2006). They already need to be locally legitimate to sustain their work, as they have no formal legal authority and are regulated largely by social sanction (Olken and Singhal, 2011). The most important concern is that community institutions remain inclusive in times of crisis and share broadly the emergency resources given to them (Gugerty and Kremer, 2008). For example, rural communities need to provide support to returning migrants rather than banning them from coming home for fear of the contagion. Another concern is that non-state institutions enrolled in social protection efforts need also be onboard with governments’ public health strategy (e.g. some religious organisations have been promoting alternative ways of dealing with the pandemic[39]).

Conclusion

Our analysis highlights that governments in developing countries will have to find creative solutions to build a comprehensive social protection response to the economic impacts of the COVID-19 epidemic. Job retention programmes already existed in some countries (e.g. Brazil) and could be used more widely to protect employment in the formal sector.[40] Some governments, as in Chile or India, have leveraged id-linked bank accounts opened for financial inclusion purposes to provide direct support to the poor. Even populations that live at the margins of social protection systems, like migrant workers in the informal sector who are not registered where they work, can be reached through associations that work with them (like the Aajeevika Bureau for internal migrants in India).

Yet, any government response will be imperfectly targeted, with important inclusion and exclusion errors. Government responses based on social insurance programmes may reach many formal employees and registered self-employed (although coarsely), but will miss the informal sector, which is an important part of developing countries’ workforce. Social assistance programmes allow governments to broaden the base of their response, but their targeting is always specific to a particular dimension of poverty, and their delivery is often plagued with “leakages”. Involving local governments or non-state actors to help provide assistance presents clear opportunities, but also runs the risk of resources being diverted by local elites or used for clientelism. Together, these policies may reach some households through several channels at once while leaving others with no direct support. However, in an emergency, the benefits from improving targeting and reducing leakages may not exceed the costs if an improved process leads to long delays in implementation.

Fortunately, even imperfectly targeted transfers will reach some “left-behind” households through family, informal, or formal sharing structures. Existing social protection transfers are often widely shared in families and extended networks even outside times of crisis. For instance, South African pensions received by grandparents benefit grandchildren (Duflo, 2003) and young adults in the household (Ardington et al., 2009). Households ineligible for Progresa cash transfers still get loans and gifts from eligible households in the same village and have higher food consumption (Angelucci and di Giorgi, 2009). Government could acknowledge explicitly that their emergency response will not reach all households and encourage beneficiaries to share their resources with others whom they identify as being in need, possibly subsidizing means of money transfers (e.g. reducing fees for bank or mobile money transfers[41]). Charitable giving could be encouraged in response to the crisis and channelled to vulnerable populations (e.g. zakat funds in Muslim communities in Bangladesh before Ramadam[42]). In fact, national funds run by governments and businesses have already raised record amounts in some countries.[43]

The challenge of mitigating the economic effects of the pandemic is enormous. Any solution will be flawed in many ways because speed is of the essence. But governments, donors and civil societies have made major gains in the last 30 years in building infrastructure to reach the poorest. If internal and external financing can be found, developing countries can use this to create the economic space for an effective public health response.

Endnotes

[*] The authors work on social insurance, social assistance, and informal structures of risk-sharing in a range of developing countries, including Brazil, Ethiopia, India, Kenya, and South Africa. We thank Arun Advani, Sebastian Axbard, Anne Brockmeyer, Ranil Dissanayake, Simon Franklin, Lucie Gadenne, Rema Hanna, Lukas Hensel, Mahreen Khan, Julien Labonne, Lorenzo Lagos, Axel Eizmendi Larrinaga, Gianmarco Leon, Winnie Mughogho, Joana Naritomi, Paul Niehaus, Barbara Petrongolo, Simon Quinn, Moizza Sarwar, Alex Solis, and Michael Walker for their thoughtful feedback and explanations of some of the policies implemented in different countries. All remaining errors are our own.

[1] Financial Times, 2020, “Coronavirus Tracked: The Latest Figures as the Pandemic Spreads.”

[2] Oxford COVID-19 Government Response Tracker; Nature News, 2 April 2020, “How Poorer Countries are Scrambling to Prevent a Coronavirus Disaster.”

[3] UNU-WIDER, 2020, “Estimates of the Impact Of Covid-19 on Global Poverty.”

[4] See http://www.ugogentilini.net/ for the World Bank and ILO’s updated list of policies adopted worldwide.

[5] See for instance: Time, 7 April 2020, “Fewer Doctors, Fewer Ventilators: African Countries Fear They Are Defenseless Against Inevitable Spread of Coronavirus;” Dahab et al. (2020); World Politics Review, 20 March 2020, “Refugees Are Being Ignored Amid the COVID-19 Crisis.”

[6] Financial Times, 6 April 2020, “Iran Steps Up Support for Citizens as it Eases Coronavirus Controls.”

[7] The Economist, 2 April 2020, “Emerging-market Lockdowns Match Rich-world Ones. The Handouts Do Not.”

[8] IMF, 9 March 2020, “How the IMF Can Help Countries Address the Economic Impact of Coronavirus.” Hausman, R., 24 March 2020, “Flattening the COVID-19 Curve in Developing Countries.”

[9] Le Monde, 9 April 2020, “L’Iran Met Fin Au Confinement Pour Éviter L’effondrement Économique.”

[10] For further reading, see the articles listed at the end of the reference section.

[11] Conflict states face additional specific challenges (e.g. Dahab et al. 2020). See also OCHA, 30 March 2020, “Pooled Funds Response To COVID-19” on co-ordinated international responses.

[12] See G. Giupponi and C. Landais, 1 April 2020, “Building Effective Short-time Work Schemes for the Covid-19 Crisis” for a discussion of key implementation details that are likely relevant in all countries.

[13] The Nation, 9 April 2020, “Cabinet Okays Compensation for Employees of Suspended Hotel, Lodging Businesses.”

[14] MapNews, 26 March 2020, “Covid-19: Net Monthly Flat-rate Allowance of MAD 2,000 for Employees Declared to Social Security Fund in Temporary Work Stoppage.”

[15] Secretaria Especial de Previdência e Trabalho, 1 April 2020, “Programa Emergencial de Manutenção do Emprego e da Renda.” Department of Labour, 26 March 2020, “Disaster Management Act: Directive: Coronavirus Covid19 Temporary Employee / Employer Relief Scheme.”

[16] For example, Kenya has implemented several policies to relieve firms’ tax burden (see the statement by President Uhuru Kenyatta on 25 March 2020).

[17] The Economic Times, 31 March 2020, “Finance Minister Nirmala Sitharaman Announces Rs 1.7 Lakh Crore Relief Package For Poor.”

[18] Self-employed workers are often not required to declare their income level for tax purposes. They may have to declare their gross revenue, but this may be a poor measure of their income, e.g. if they have sizable input cost or under-reported their past revenue to minimize tax liabilities.

[19] O Globo, 7 April, 2020, “Tire Suas Dúvidas Sobre o Auxílio Emergencial de R$ 600.”

[20] The Guardian, 2 April 2020, “Millions in UK ‘could slip through virus wage safety net.”

[21] South Africa, for instance, quickly made available R500 million to assist small and medium enterpises (see the statement by President Cyril Ramaphosa on 24 March 2020).

[22]Bassier, M., J. Budlender, M. Leibbrandt, R. Zizzamia, V. Ranchhod. 31 March 2020. “South Africa Can – And Should – Top Up Child Support Grants To Avoid A Humanitarian Crisis.”

[23] The Economic Times, 31 March 2020. “FM Nirmala Sitharaman Announces Rs 1.7 Lakh Crore Relief Package For Poor.”

[24] Tempo.Co, 5 April 2020, “Dampak Covid-19, PKH Disalurkan Bulanan Mulai April.”

[25] See the statement by President Uhuru Kenyatta on 25 March 2020.

[26] The name of the programme is “Bonus I stay at home”. Labeling assistance programmes may be an effective way to induce compliance to public health policies (Benhassine et al. 2015 show that labeling a cash transfer to promote children’s education is as effective as making it conditional on enrolment).

[27] The Conversation, 1 April 2020, “Coronavirus: How Pakistan Is Using Technology To Disperse Cash To People In Need.”

[28] India Today, 26 March 2020, “Bihar Govt To Bear Expenses Of Migrant Workers Stranded In Other States: Nitish Kumar.”

[29]El Comercio, 1 April 2020, “¿Cómo Saber Quiénes Más Recibirán El Bono de 380 Soles por Coronavirus en Perú?.”

[30] The World Food Programme and United Nations Office for the Coordination of Humanitarian Affairs collaborate on early warning systems for severe food insecurity https://hungermap.wfp.org/.

[31] See interviews with Hans Rosling: Science, 2 December 2014. “Star Statistician Hans Rosling Takes on Ebola” and https://www.youtube.com/watch?v=60H12HUAb6M.

[32] KT Press, 29 March 2020, “Rwanda: How COVID-19 Relief Distribution Will Work.” The usual social protection also involves communities in targeting to verify that applicants for social assistance are needy (see Republic of Rwanda, 3 February 2015, “Community-led Ubudehe Categorisation Kicks Off”).

[33] IGIHE, 6 April 2020, “Coping: Kigali City Opens 3260 Toll–free Line to Address Food Needs Inquiries.”

[34] News18, 28 March 2020, “Govt Changes Rules to Help Migrant Workers Amid Covid-19 Lockdown, State Disaster Funds to be Used for Providing Food, Shelter.”

[35] Ideas for India, 20 July 2017, “India’s Slum Leaders.”

[36] E.g. https://redesdamare.org.br/br/quemsomos/coronavirus for the Mare favela in Rio de Janeiro.

[37] Economic Times, 26 March 2020, “Realtors Say Govt’s Directive to Use Welfare Fund to Help Labourers’ to Mitigate Epidemic Loss.”

[38] Reuters, 25 March 2020, “Using Lessons from Ebola, West Africa Prepares Remote Villages for Coronavirus.”

[39] The Diplomat, 25 March 2020, “Sociocultural and Religious Factors Complicate India’s COVID-19 Response.” Oxfam Blogs, 27 March 2020, “Across Africa, Covid-19 Heightens Tension Between Faith and Science.”

[40] As a response to the crisis, China has helped firms but does not seem to have protected employment (South China Morning Post, 25 March 2020, “China is Winning the Covid-19 Fight but Losing the Economic War”).

[41] Transfer fees for Kenya’s popular mobile money system were recently waived, although for a public health reason (Finextra, 16 March 2020, “Covid-19: M-pesa Waives Fees to Discourage Cash Usage”).

[42] Atlantic Council, 30 March 2020, “Defusing Bangladesh’s Covid-19 Time Bomb.”

[43] South Africa’s Solidarity Fund, a partnership of government and business, has raised £85 million in two weeks, £25 million from donations from ordinary citizens (https://www.solidarityfund.co.za/; Cape Talk, 2 April 2020, “Thousands of Ordinary South Africans Have Contributed to the Solidarity Fund”). Nigeria’s similar version, run by the central bank, raised £33 million in a week. CNBC Africa, 2 April 2020, “Nigeria’s Private Sector Coalition Raises N15.3bn to Fight Covid-19.”