This policy brief represents the views of the authors and not necessarily those of the

Bank for International Settlements or the Federal Reserve Bank of New York.

The share of income that goes to top earners has reached levels not seen in over half a century, and addressing inequality has become a central issue for policymakers. Designing policies to alleviate income disparities requires a thorough understanding of how inequality affects the economy. Somewhat surprisingly, while several studies investigate the consequences of rising income inequality for households (Auclert and Rognlie 2017, 2020; Mian et al. 2020), much less is known about how inequality affects firms.

In a recent study (Doerr et al. 2022), we examine the important link between income inequality and firms’ job creation. Our analysis of US data reveals that a larger top income share hurts small firms, while benefiting larger firms. The reason is that households’ savings portfolios change with their income level. Higher income inequality leads to more household savings flowing into stocks and bonds – which are mostly used for financing by larger firms – rather than into bank deposits. In turn, as small businesses depend on banks for financing, their funding becomes more costly and they create fewer jobs.

Complementing our analysis with a theoretical model, we show that by altering the allocation of household savings, rising income inequality not only hurts small firms, but suppresses overall employment. Income inequality has thereby contributed to two important macroeconomic trends: the decline in small business and the fall in the labor share, i.e., the share of total income that accrues to workers (Decker et al. 2016; Autor et al. 2020).

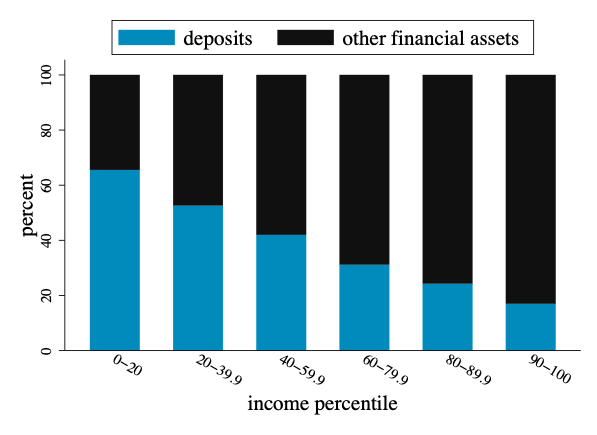

Figure 1: The allocation of financial assets across income groups

The effects of rising top incomes on job creation

The detrimental effect of inequality on job creation is explained by the fact that households’ savings behavior changes as they become richer. As Figure 1 shows, deposits (such as checking and savings accounts) make up more than 60% of the total financial wealth for the bottom 20% of the income distribution. Yet they account for less than 20% among the richest 10% of households. High-income earners instead invest directly in capital markets, for example by holding stocks and bonds. The negative link between income and deposit shares suggests that as the income share of top earners rises, a relatively larger share of total financial assets is held in the form of stocks and bonds. Meanwhile the share of bank deposits declines.

We argue that more dollars in the hands of high-income rather than low-income households hence lead to fewer jobs created by small firms, while large firms expand. The reason is that greater inequality translates into lower funding costs for large firms but higher funding costs for small firms. It does so for two reasons. On the one hand, large firms have access to capital markets and hence benefit from a greater demand for stocks and bonds. On the other hand, banks’ access to deposits affects their cost of funds and ability to extend credit (Ivashina and Scharfstein, 2010; Drechsler, Savov and Schnabl, 2017), and small firms rely predominately on banks as a source of funding (Chodorow-Reich, 2014; Liberti and Petersen, 2019). As fewer savings are held in the form of deposits, rising top income shares increase banks’ cost of funds and thereby curtail credit supply. This hurts smaller bank-dependent firms.

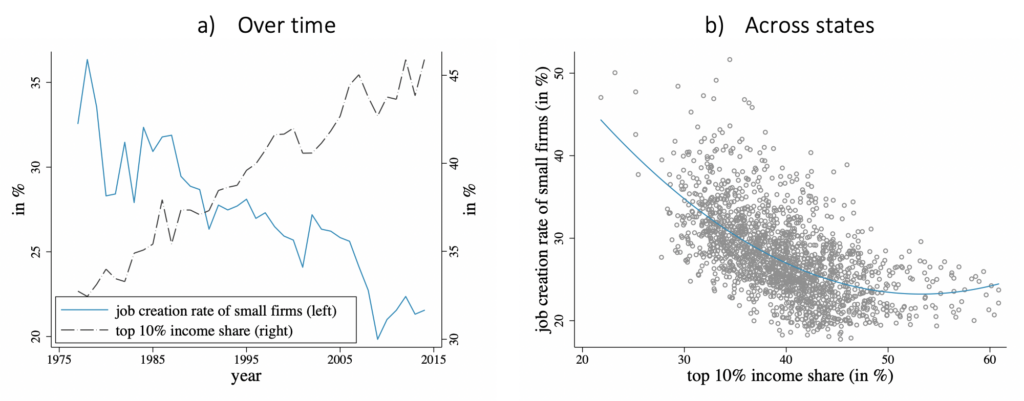

Figure 2: The rise in top incomes and the decline in small business

The data show a strong negative relationship between top income shares and small firm job creation in the US. Panel (a) in Figure 2 shows that as the top 10% income share rose from around 30% in 1980 to almost 50% today, the job creation rate of small firms steadily declined. The negative association between top incomes and job creation is also present in individual states: Panel (b) shows that US states with higher top income shares experience systematically lower job creation by small firms.

We conduct a formal empirical analysis using the variation across US states and time in net job creation of firms of different sizes. The idea behind our strategy is that equity and bond markets work nationwide, while banks’ deposit collection and lending to small firms occurs more locally. We find that a 10 percentage point increase in the top 10% income share leads to a 2.5 percentage point decline in the net job creation rate of small firms relative to larger firms. This effect is economically sizable: the top 10% income share has increased by about 10% between 1980 and 2015, while the average job creation rate at small firms in the 1980s was 4.2%. These effects are not driven by alternative explanations, such as technological change, lower spending on public goods, or changes in local real estate prices.

Consistent with the proposed portfolio channel, we find that rising top income shares reduce the amount of bank deposits, while increasing banks’ interest expense on deposits. That is, the cost of funds increases for banks – and thereby for small firms. We also find that the effect of rising income inequality on job creation is stronger the smaller the firm, reflecting that smaller firms rely more on banks due to higher informational frictions. When we further split industries into those that are more or less bank-dependent (following Doerr 2022), we find that small firms’ job creation in bank-dependent industries declines by more when top incomes rise.

The decline of small business and consequences for wages and welfare

How much of the overall decline in small business is due to the rise in income inequality? And to what extent can growing inequality explain other macroeconomic developments? Answering these questions requires us to combine our estimates with a theoretical model. We thus build a macroeconomic model that we calibrate to our empirical findings. The model shows that the increase in the top income share between 1980 and today, from 30% to 50%, accounts for about 1 percentage point of the decline in the share of employment at firms with fewer than 500 employees. Since this share has fallen by around 5 percentage points since 1980 in the US, rising top incomes, through their effect on firms’ funding conditions, explain almost 20% of this overall decline.

Small firms further tend to operate with a higher labor ratio, as they employ more workers per unit of capital. The rise in the top income share and induced shift in economic activity towards larger firms hence suppressed aggregate employment and contributed to the decline in the labor share, a key trend in the US and globally (Karabarbounis and Neiman 2013; Autor et al. 2020).

Beyond the effects of rising top incomes on firms and aggregate activity, we find that ignoring the link between households’ savings decisions, the banking sector, and firms’ job creation understates the effects of redistributive policies on welfare. If income is redistributed to lower-income households, more resources flow to small firms via banks. In turn, wages – the main source of income among poorer households – increase. This feedback channel amplifies the positive effects of the policy on the incomes and welfare of lower-income households. In other words, policy proposals that aim at reducing income inequality have greater welfare consequences when taking the effects of inequality on job creation into account.

Conclusion

While existing studies have investigated the effects of rising top incomes on households, this policy brief discussed the important link between income inequality and job creation. An analysis of US data shows that growing inequality has contributed to the decline in small business and suppressed overall employment. The economic mechanism that we uncover in our study suggests that policy initiatives addressing the rise in inequality could benefit poorer households well beyond the effects that occur directly through redistribution. Indirect effects on firms’ job creation – and hence wages – also play an important role.

References

Auclert, Adrien and Matthew Rognlie (2017) “Aggregate Demand and the Top 1 Percent”, American Economic Review: Papers & Proceedings, 107 (5), pp. 588–592.

Auclert, Adrien and Matthew Rognlie (2020) “Inequality and Aggregate Demand”, Working Paper.

Autor, David, David Dorn, Lawrence F Katz, Christina Patterson, and John Van Reenen (2020) “The fall of the labor share and the rise of superstar firms”, The Quarterly Journal of Economics, 135 (2), pp. 645–709.

Chodorow-Reich, Gabriel (2014) “The employment effects of credit market disruptions: Firm-level evidence from the 2008–9 financial crisis”, The Quarterly Journal of Economics, 129 (1), pp. 1–59.

Decker, Ryan A., John Haltiwanger, Ron S. Jarmin, and Javier Miranda (2016) “Declining business dynamism: What we know and the way forward”, American Economic Review, 106 (5), pp. 203–07.

Doerr, Sebastian (2021) “Stress tests, entrepreneurship and innovation”, Review of Finance 25(5), pp 1609-1637.

Doerr, Sebastian, Thomas Drechsel and Donggyu Lee (2022) “Income Inequality and Job Creation”, Working Paper.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl (2017) “The Deposits Channel of Monetary Policy”, Quarterly Journal of Economics, 132 (4), pp. 1819–1876.

Ivashina, Victoria and David Scharfstein (2010) “Bank lending during the financial crisis of 2008”, Journal of Financial Economics, 97 (3), pp. 319–338.

Karabarbounis, Loukas and Brent Neiman (2014) “The Global Decline of the Labor Share”, The Quarterly Journal of Economics, 129 (1), pp. 61–103.

Liberti, José María and Mitchell A. Petersen (2019) “Information: Hard and Soft”, Review of Corporate Finance Studies, 8 (1), pp. 1–44.

Mian, Atif, Ludwig Straub, and Amir Sufi (2020) “The saving glut of the rich”, Working Paper.