Introduction

Rich and poor countries alike are facing an unprecedented economic crisis as they attempt to contain the impact of the COVID-19 pandemic. A downturn of this magnitude can cause tremendous long-term damage, with critical economic linkages between employees, businesses, and banks at risk of disappearing forever. Scores of firms will close permanently unless urgent action is taken. The threat is even more significant for emerging economies, where the economic costs of social distancing are likely to be higher, and where vulnerable small and medium sized enterprises with low cash reserves account for a much larger share of the economy than in rich countries, which can rely on extensive social and economic safety nets. Poor countries, moreover, have far more precarious health-care systems. The funds required to support vulnerable workers and businesses, and to care for COVID-19 patients, could be as high as 10% of their GDP. As a comparison, in the US the rescue measures passed in the last month alone account for at least 10% of GDP, and are likely to increase even more.[1] A number of European countries have commited loans, equity injections and guarantees up to 35% of GDP.[2]

The COVID-19 crisis has led to a sudden collapse in capital flows to emerging and developing countries. According to estimates by the Institute of International Finance, non-resident portfolio outflows from emerging market countries amounted to nearly $100 billion over a period of 45 days starting in late February 2020. For comparison, in the three months that followed the explosion of the 2008 global financial crisis, outflows were less than $20 billion.[3]

Advanced economies can borrow large amounts at little extra cost. Moreover they benefit from flight-to-safety funding from foreign investors and from U.S. investors liquidating their foreign holdings. In other words, the financing that the U.S. and other advanced economies rely on comes in part from emerging market economies where, ironically, the financial needs are more pressing. What’s more, in contrast to the 2008 global financial crisis, every emerging and developing economy now confronts greater borrowing needs at exactly the same time. Even if a country like Mexico were able to issue bonds, it would be competing with many other countries at the same time. The reality is that countries have no one else to borrow from but other countries.

Left to their own devices financial markets will pick winners and losers. The winners will be those countries that already have enough borrowing capacity. They will be able to borrow large amounts at rock-bottom interest rates. The losers will be the world’s Mexicos or Cameroons. These countries will be doubly punished: not only will they be unable to raise funds to deal with the crisis, but capital will also move away, as it has already started to, precisely because of the increase in borrowing by the US, China, and European countries.

It is little wonder, then, that about 100 countries have already approached the International Monetary Fund for financial assistance. Fighting a global pandemic is all about strengthening the weakest links. Eradication of COVID-19 is a weakest link public good (Barrett 2006).

In response to this crisis, the Group of 20 leading economies agreed to a temporary debt service standstill on bilateral official loan repayments from a group of 76 of the poorest countries (the so-called IDA countries).[4] This is a positive first step, but the agreement needs to be extended along two dimensions. First, the exclusive focus on the poorest countries leaves out many low and middle income countries that already face severe economic strains. Second, a key constituency missing from the G20 plan is private creditors whose participation is sought only on a voluntary basis. Although they are not the most important creditors of IDA countries, they are crucial for middle income countries such as Mexico, where they hold the majority of the sovereign debt.

In the absence of private sector participation, official debt relief in middle income countries may partly be used to service private creditor claims. Given the expected size of the fiscal needs of these countries, any financial relief dissipated on debt servicing of private creditors claims will be very costly. Moreover, participation by private creditors cannot be wholly “voluntary”. If participation is voluntary, relief provided by those private creditors that participate will simply subsidize the non-participants. And history teaches us that a significant number of private creditors will not volunteer to participate.

In sum, for emerging and developing countries to be able to withstand the economic shock, it is imperative to include all private creditors as a part of a future debt standstill. We propose that multilateral institutions such as the World Bank or other multilateral development banks create a central credit facility allowing countries requesting temporary relief to deposit their stayed interest payments to official and private creditors for use for emergency funding to fight the pandemic. Principal amortizations occurring during that period would also be deferred, so that all debt servicing would be postponed.

The facility would be monitored by a multilateral lending institution to ensure that the payments that otherwise would have gone to creditors be used only for emergency funding related to the global pandemic. Our assumption is that all funding from this emergency facility and associated deferred principal payments would eventually be repaid by the country, and that investors would get their money after the crisis is over. We estimate that a 12 month debt standstill from both bilateral and private sector creditors would provide around $800 billion in resources for emerging and developing countries (ex-China), representing 4.7% of their annual income.

Domestic contract law regimes incorporate doctrines that allow the performance of a contract to be suspended (or occasionally avoided entirely) upon the occurrence of events that are wholly unforeseen, unpredictable and unavoidable. For its part, public international law recognizes, in a doctrine called “necessity”, that states may sometimes need to respond to such exceptional circumstances even at the cost of suspending normal performance of their contractual or treaty undertakings. COVID-19 meets all of the criteria for such an exceptional phenomenon. Countries badly afflicted by this pandemic will need to deploy their available financial resources in immediate crisis amelioration measures. Those funds must be obtained from several sources—a diversion of budgetary amounts that had been earmarked for other purposes before the crisis, loans or grants from official sector institutions and a redirection of money that had been intended for scheduled debt service. In making these adjustments, the states concerned will not be acting in a discretionary or optional manner; in the truest sense of the word they will be acting out of necessity. We believe that everyone, and particularly the G-20 countries, should publicly acknowledge this fact in the context of recommending a standstill on debt service payments under bilateral and commercial credits for a limited period.

What is at Stake

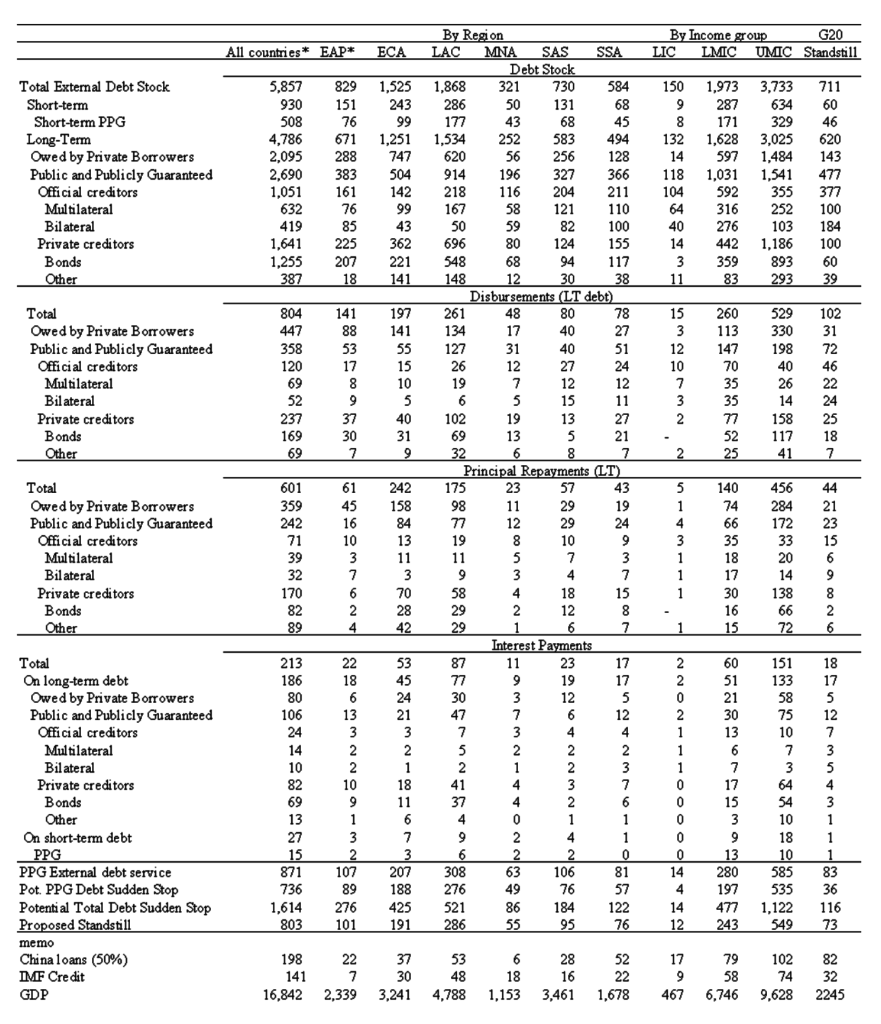

In 2018 developing and emerging market countries (excluding China) had a stock of external debt of approximately $5.9 trillion. About 82% of this debt ($4.8 trillion) was classified as long-term (with original maturity greater than one year), with $2.1 trillion owed by the private sector and $2.7 trillion either owed to or guaranteed by the public sector. Of the public sector external debt, about 40% was owed to the official sector ($600 billion to multilateral creditors and $400 billion to bilateral) and the remaining 60% to private creditors (bonds amounted to $1.3 trillion and bank loans to $380 billion).[5]

One way of estimating the effect of the COVID-19 crisis on the ability of emerging and developing countries to roll-over their external public debt is to assume that these countries will lose market access at least until the end of 2020.[6] If official financing remains constant, net flows tied to long term debt with official creditors are expected to be $25 billion ($120b disbursements minus $71b principal repayment and $24b in interests) and net flows with private creditors amount to -$252 billion, as there will be principal and interest payments due ($170b and $82b, respectively) but no disbursements (which in 2018 amounted to $237b). Hence, the estimated shortfall on long term debt flows will be $227 billion.

To this figure, we need to add short-term debt. We do not have detailed data on the share of short-term external debt owed by public sector borrowers, but it could be as high as $500 billion. Bringing the total shortfall to $735 billion (for details, see Table 1 in the Appendix). This total shortfall provides an estimate of the potential public sector sudden stop, while the total sudden stop would also include equity flows and lending to private debtors.

The recent G20 decision to grant debt relief to the poorest countries focuses on the bilateral debt of the group of countries which are eligible to borrow from the World Bank concessional window (the International Development, Association, IDA) plus Angola. The total shortfall for this group of countries (last column of Table 1 in the Appendix) is estimated at $36 billion. The principal and interest due by these countries to bilateral creditors (the focus of the G20 action) is $14 billion, less than 2% of our estimates for the public sector sudden stop associated with COVID-19 across all low and middle income countries.

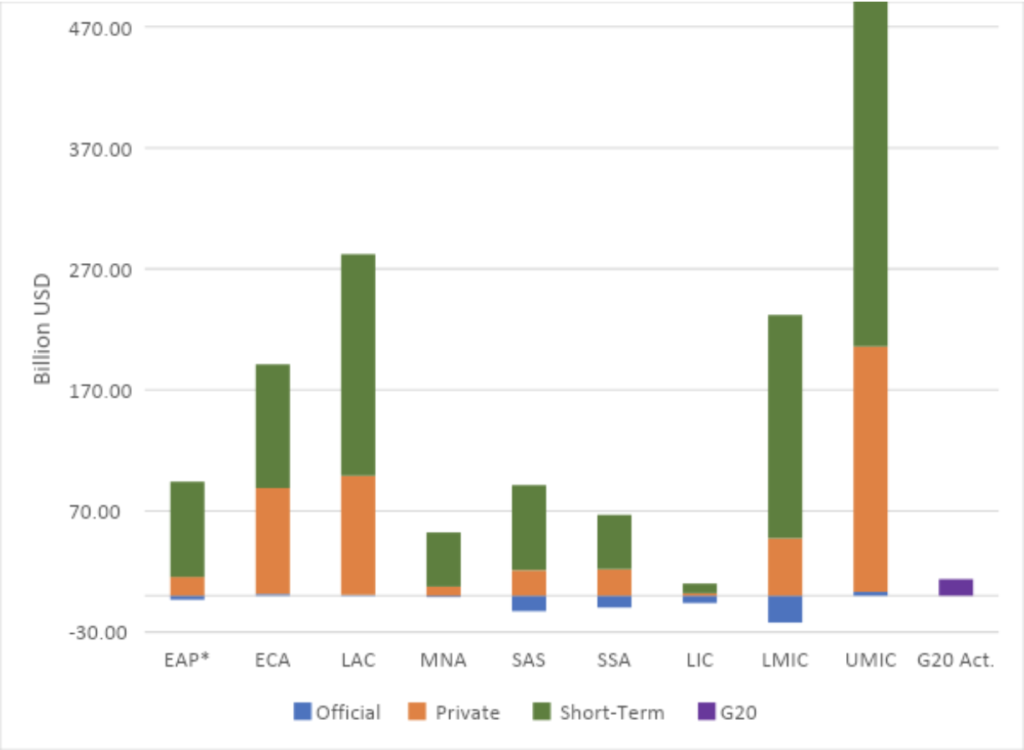

Figure 1 shows how this shortfall varies across geographical regions and income groups. The most affected region will be Latin America and the Caribbean, followed by Emerging Europe. For Emerging Europe about 50% of the sudden stop will be associated with the need to service and rollover long-term external debt and the remaining half related to short-term debt flows.[7] For Latin America and the Caribbean about two-thirds of the sudden stop will be associated with short-term debt rollover needs.[8] The figure also shows that for middle income countries “business as usual” net-official inflows (which tend to be positive and hence have a negative value in our measure of shortfall) cannot be expected to compensate the expected sudden stop in bond and bank financing. The Figure also shows that the G20 debt relief of April 16, $14 billion, is very small compared to the total expected shortfall.

Figure 1: Potential public sector sudden stop

This figure plots the potential public sector sudden stop across geographical regions and borrowing groups. It assumes business as usual net flows from official creditors. The G20 Act. Bar plots the debt relief measure implemented by the Group of 20 on April 16, 2020.

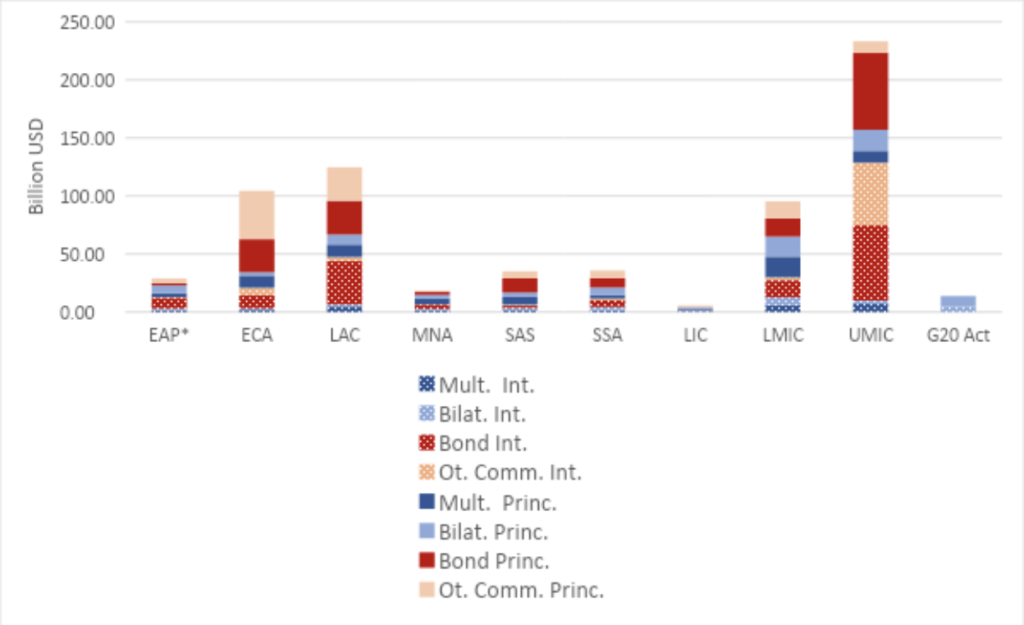

As there is some uncertainty on the share of external short-term debt owed by the public sector, Figure 2 provides a detailed breakdown concentrating on the long-term component of this potential public sector sudden stop. In Emerging Europe, most of the potential public sector sudden stop on long-term debt (80%) is related to the need to rollover maturing bonds and loans, while in Latin America interest payments amount for more than 40% of financing needs (about the same as for the group of upper middle countries).

Figure 2: Public sector external debt service (only long-term debt)

This figure plots the potential public sector debt service needs across geographical regions, borrowing groups, and creditor groups (Multilaterals, Bilaterals, Bond, Other Commercial Creditors). The dotted bars measure interest payments (Int.) and the solid bars repayment of principal (Princ.). The G20 Act. Bar plots the debt relief measure implemented by the Group of 20 on April 16, 2020.

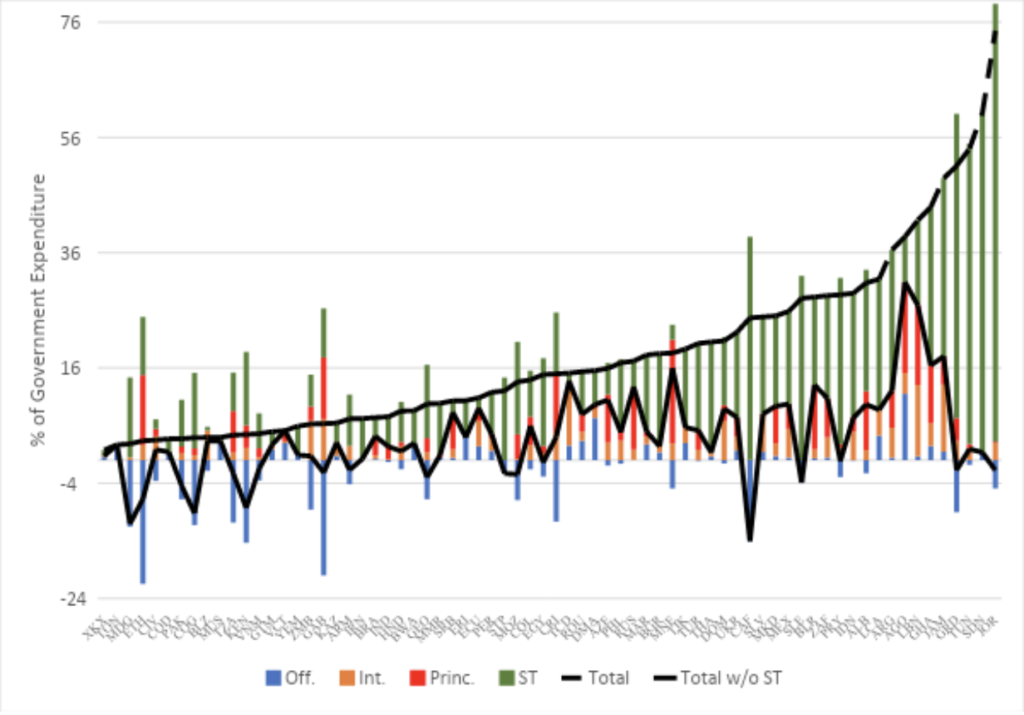

Figures 3 plots country-specific estimates of the public sector sudden stop, expressed as a share of total government expenditures. There are 35 countries for which the public sector sudden stop will amount to more than 15% of government expenditures and 24 countries where the potential public sector sudden stop is greater than 20% of public expenditures.

Figure 3: Potential public sector sudden stop as a share of government expenditure

This figure plots the potential public sector sudden stop as a share of government expenditure for all countries where this share is larger than 1%, broken down into Official net flows (Off), Private creditors Interest Payments on long-term debt (Int.), Private creditors principal repayments on long-term debt (Princ.) and public sector short-term debt (ST). The dashed line plots the potential sudden stop including short-term debt and the solid line excludes short-term debt.

We should interpret these figures with caution. On the one hand, they may overstate the problem since they assume a complete sudden stop in private sector financing. It is possible that not all short-term credit will collapse, and some countries may even be able to maintain access to long term debt. For instance, at the end of March, Panama managed to issue a $2.5 billion sovereign bond in the international debt market. Similarly, we may be overestimating the share of short-term debt owed by the public sector. On the other hand, these figures are likely to greatly understate the problem as they do not take into account funding gaps associated with:

- The collapse of international lending to the private sector (which accounts for 40% of total long-term external debt developing countries);

- The sudden stop in equity flows (both portfolio and FDI)

- The currency depreciation which will increase the cost of serving foreign currency loans.

An increase in official disbursement equal to all payments due to the official sector could close about 13% of this shortfall ($71 billion in principal repayment and $24 billion in interests), but developing and emerging market countries will still need an additional $640 billion. One possibility would be to greatly scale-up official sector lending. Landers, Lee, and Morris (2020) estimate that the lending capacity of the multilateral development banks (MDBs) could increase by more than $1 trillion.

Yet these figures assume a constant public sector expenditure and deficit. Hence they fail to recognize that the sudden stop comes while GDP in emerging and developing economies is expected to contract by 1% in 2020 (with contractions as large as 5% in Emerging Europe and Latin America) according to the April 2020 IMF World Economic Outlook projections, down from 3.7% output growth in 2019. Lower economic activity will reduce tax revenues while government expenditures must increase to protect citizens and the economy. Overall, the IMF estimates that emerging economies’ funding needs will total $2.5 trillion, a figure that we find conservative.[9]

Even a dramatic increase in MDB lending will not be sufficient and the private sector will have to be involved in offering relief. The G20 could enable a generalized private sector debt suspension by coordinating a stand-still that would apply to all sovereign-debt payments due by emerging and developing economies that requested such a freeze, and that would remain in place until the health crisis passes (Gourinchas and Hsieh, 2020). Such a standstill could free up to $803 billion corresponding to 4.7% of the total GDP of emerging and developing countries.[10]

The standstill may well bring private lending to the countries that request it to a full stop, but for all intents and purposes such capital flows have already stopped or even been reversed. Perhaps the standstill may lock these countries out of international capital markets for some time, but the stigma from the suspension on this occasion should be feared much less given that it is a necessity brought about by a worldwide pandemic rather than the result of fiscal profligacy. The official sector’s endorsement of the necessity of such a generalized standstill would also minimize any reputational or legal risk. A key issue, as always is how to get the entire private sector involved and how to limit free riding.

For purposes of our analysis, we put aside short-term claims that are typically governed by the domestic laws of the issuer and, therefore, more pliable (see Buchheit and Gulati 2019). Our focus instead is on external debt issued under foreign laws. Here, a coordinated effort by the G-20 to apply a generalized standstill to all debt payments due by an emerging or developing country that requests such a pause in payments would go a long way in addressing this issue. Our proposal provides a concrete roadmap to achieve an effective coordinated debt relief between the official and commercial sectors.

The Proposal

Mechanics. Implementation of an emergency standstill, particularly for commercial creditors of middle income countries, presents a challenge. Some countries will have dozens of external debt instruments with hundreds or even thousands of individual creditors. Attempting a bespoke standstill negotiation for each of those instruments is impractical. It would take many weeks or months at the very time when the debt relief is needed most critically. No individual commercial creditor or group of creditors will be in a position to prescribe eligible uses for the money that would otherwise have gone toward debt service much less be in a position to monitor and verify how those funds are actually spent. Individually negotiated amendments to existing debt instruments will inevitably produce a welter of incongruent conditions, financial terms, covenants and so forth, probably at ruinous legal expense. Therefore, all creditors will be asked for the same relief — a standstill on interest payments for a prescribed period. Since a bespoke implementation of that request will result in choppy, inconsistent outcomes among affected creditors, we suggest a streamlined approach as follows:

- The World Bank or the multilateral development bank for the region concerned would open a central credit facility (a “CCF”) for each country requesting this assistance. The CCF would specify the eligible crisis amelioration uses for drawings under the facility, as well as the arrangements for monitoring the use of proceeds.

- In view of the nature of this emergency, each CCF should have terms (interest rate and amortization) that will not aggravate the post-COVID-19 financial position of the beneficiary country.

- Once a CCF is in place for a country seeking this assistance, the debtor country would notify each of its bilateral and commercial creditors that interest payments on existing debt instruments falling due during the prescribed standstill period will be directed to (and reinvested in) the CCF. Each lender would also receive a formal request from the debtor country seeking the lender’s acknowledgment that the reinvestment of the interest payment into the CCF (and the crediting to the lender’s account of a corresponding interest in the CCF) will constitute a full discharge and release of the borrower’s obligation in respect of the relevant interest payment.[11] For indebtedness in the form of international bonds, this acknowledgment will probably be sought through a consent solicitation addressed to all holders of each such bond.

- The threshold decision about whether to seek a standstill on interest payments for a limited period will, of course, rest in the discretion of each sovereign debtor. Some countries may be spared the worst of the pandemic and will not need this relief while others may continue to enjoy market access during this period and would not wish to jeopardize that status by deferring current interest payments.

Principal amortizations. Participating countries with principal amortizations falling due during the standstill period will need to defer those amounts. It would obviously be inconsistent to seek a standstill on interest amounts while simultaneously paying principal. Such deferral could be handled in one of several ways. The official sector might encourage, perhaps even insist, that all participating countries with principal payments falling due during the standstill period enter into more or less simultaneous exchange offers at the beginning of the process to reschedule those principal amounts. This would address the issue in a coordinated and possibly uniform manner at the outset. Alternatively, some creditors may prefer voluntarily to reinvest their principal payments into the CCF, thereby taking advantage of both the de facto seniority of the CCF and the automatic monitoring of proceeds embedded in the CCF. The other option would involve negotiating deferrals of principal payments on a case-by-case basis. Only a subset of participating countries will have principal maturing during the standstill. The important task is to effect a deferral of those amounts so that they do not result in a diversion of funds intended for crisis amelioration measures. The precise manner in which that objective is accomplished can be left to the debtor countries and the affected creditors.

Sustainability considerations. Some countries will have had unsustainable debt positions before the COVID-19 crisis hit, others will have unsustainable debt positions after the crisis abates. A standstill on interest payments for the balance of 2020 or slightly longer does not preclude or prejudge a more durable debt restructuring for one of these countries at the appropriate time. A CCF, in light of its origin and purpose, ought to be considered a de facto senior instrument in such a debt restructuring, the equivalent of debtor-in-possession financing in a corporate insolvency. Because the aggregate amounts redeployed through a CCF should for any given country be small (equal to interest accruals for +/- 12 months), the effect of such a recognition of seniority in a general debt restructuring should be negligible.[12]

Necessity. We perceive little political enthusiasm for a resurrection of proposals for an institutionalized sovereign bankruptcy regime, nor is there any time to design and implement such a regime in the middle of this crisis. There is one measure, however, that the official sector could take that may assist debtor countries if legal challenges are raised by minority creditors to these arrangements. In any public statement about these measures and the global emergency that gave rise to the measures, the G-20 could recognize that both official sector institutions and the debtor countries are acting out of necessity, referencing Article 25(1) of the Articles on State Responsibility promulgated by the International Law Commission in 2001.[13]

Advantages. Implementing a standstill on interest payments for a prescribed period through these arrangements would have the following advantages:

- All participating creditors in each country (bilateral and commercial) would be treated equally. All would receive an identical instrument (an interest in that country’s CCF) corresponding to the amount of their reinvested interest payments.

- All issues related to the identification of eligible crisis amelioration expenditures, conditions precedent to drawdowns and post-disbursement monitoring would be centralized in the CCF and administered by a multilateral institution.

- Amounts reinvested in a CCF would stand the best chance of being repaid even if the debtor country concerned eventually needs a full-scale debt restructuring.

- These arrangements can be implemented immediately after a CCF for the debtor country can be put in place, a feature that will be of critical importance as this crisis rages.

Motivation

There are two parts to the proposal. The first concerns the reinvestment of payments due into a central credit facility for the recipient country administered by a multilateral development bank or the World Bank.

This is an expedient solution to quickly administer the redirection of interest payments towards more urgent needs in poor countries that are already faced with the dire consequences of the global COVID-19 health and economic crisis. This is the primary motivation for setting up such a facility. Moreover, it would make it easier to monitor the use of funds and to keep a record of all the interest payments that have been redirected in this way.

The urgent problem is to give recipient countries immediate and comprehensive debt relief. To insist on these countries first getting consent of their creditors will introduce unnecessary and costly delay. It would largely defeat the purpose of providing debt relief.

The first step of our proposal is for the recipient country to set up a CCF with an MDB and agree to a list of eligible expenditures as well as a timeline for the later repayment of the frozen debt obligations. Once the facility is in place all the sovereign debtor would be required to do is notify its commercial and bilateral creditors that the payments due have been paid into the CCF and that the custodian of the CCF has been instructed to record an interest in the CCF in the name of the creditor. At that point the affected creditor would simply acknowledge and agree that the crediting of the CCF in this manner constitutes a full discharge and release of the debtor’s obligation in respect of the debt obligation concerned.

This procedure has several practical advantages. First and foremost it can be implemented quickly, essentially immediately upon activation of the CCF. Second, while the underlying debt instrument may be in technical default during the period between the diversion of the interest payment into the CCF and the receipt of the creditor’s consent to this action, that default should be of limited duration and may, depending on the terms of the debt instrument, be covered by the relevant grace period. Even if the commercial creditor were affirmatively to refuse to give an acknowledgment of discharge and release, the creditor’s resulting damages would be offset in large part by the value of that creditor’s corresponding interest in the CCF. Third, by treating all creditors equally, the CCF in effect assures intercreditor equity. Fourth, by limiting the debt relief to a temporary suspension of debt payments, and by protecting interest payments from misappropriation through the channeling of payments into the CCF, one can reasonably expect that few creditors will choose to opt out and seek legal remedy. The reputational cost to such holdout creditors, acting against the common interest in times of exigency, would not be worth the benefit of receiving full payment of the temporarily suspended interest and principal payments.

The second part of our proposal concerns our call to the official sector to provide some cover to debtor countries, which could face legal challenges from holdout creditors, by publicly stating the purpose of the debt relief, namely the necessary relief from debt obligations to help debtor countries face the global emergency engendered by the COVID-19 pandemic. By recognizing that the official sector creditors and the debtor countries are acting out of necessity, the G-20 would play an important certification role of the extreme and exigent circumstances they are facing. Depending on the law of the jurisdiction where a holdout creditor may elect to pursue its legal remedies, such a public statement by the G-20 may assist the sovereign debtor in defending its action as the minimally necessary to respond to the exigent circumstances of the pandemic.

Past economic crises, whether in the US or elsewhere, have sometimes led to political interventions to suspend debt payments or to make other modifications to the terms of debt contracts. Such interventions may be necessary and do not automatically undermine credit markets. In some instances they have actually had the opposite effect, resurrecting debt markets following the intervention. The reason why debt markets recovered was that creditors had anticipated widespread default in the absence of any modification of the repayment terms, and they were pleasantly surprised by the intervention that had the effect of reducing the risk of default.[14] Creditors on average preferred the certainty of receiving a reduced repayment to the very uncertain prospect of being made whole.

To be sure, creditors generally do not expect that the promised repayment of their debt contracts will always be honored. They understand that there could be circumstances when it would be essentially impossible for the debtor to meet its obligations. Had they been able to clearly and precisely anticipate these circumstances they would have modified the terms of the contract to reflect these necessities and thereby avoided a wasteful and unnecessary default.

For many reasons most debt contracts are highly incomplete and do not contain provisions prescribing how the parties will react to such contingencies. To name just one, it is very difficult to specify precisely in advance the exact form of a contingency such as a global pandemic that would merit lowering debt obligations in this event. Ex post it is easier, of course, to identify the contingency. The political intervention in debt contracts in these events serves the role of completing incomplete debt contracts. By certifying the event and by modifying the terms of the debt contract in ways that the contracting parties themselves would have wanted had they been able to, the intervention, far from undermining credit markets, helps support these markets.[15]

Not all interventions are beneficial in this way. It is important that they take place only in highly unusual and urgent circumstances that are outside the debtor’s control (“acts of God”). Unusual circumstances are precisely the ones that are hard to describe and include in a debt contract. By certifying that such an event has occurred and by acting accordingly, the G-20 would ensure that contract terms will be modified only when absolutely necessary and when the modifications are likely to support credit markets.[16]

To summarize, debt suspension in a crisis provides ex-post economic benefits by avoiding a costly default and by relaxing the liquidity constraint of debtors. These ex-post economic benefits do not negatively affect credit markets ex ante even when suspension in rare circumstances is anticipated. The reason is that the contracting parties themselves would have included lower debt obligations in these circumstances. It is the inability of the contracting parties to describe these circumstances ahead of time that explains the incompleteness of the debt contract. But the contracts can be completed through political intervention in times of exigency.

Endnotes

[1] The $2.3 trillion dollar rescue package in the US is 10.6% of US GDP in 2019 (https://www.bea.gov/news/2020/gross-domestic-product-fourth-quarter-and-year-2019-advance-estimate)

[2] See IMF 2020, Fiscal Monitor April 2020, Figure 1.1

[3] https://www.iif.com/Publications/ID/3829/IIF-Capital-Flows-Tracker-The-COVID-19-Cliff

[4] The group of countries targeted by the G20 also includes Angola, which is not an IDA country but it is classified as a Least Developed Country by the United Nations.

[5] Table A1 in the appendix provides a detailed breakdown. These values exclude IMF credit that in 2018 amounted to approximately $155 million. There are several caveats with the data reported here which are based on the World Bank’s International Debt Statistics (IDS). First, IDS may not include all the domestically issued bonds which are held by non-residents (and hence should be classified as external debt). For instance, Arslanalp and Tsuda (2014) track the ownership of central government bonds owned by non-residents in a group of 15 large emerging market countries and for many countries report values that are much larger than the values reported by IDS. Arslanalp and Tsuda (2014) also report larger share of local currency bonds owned by non-residents). For a detailed discussion of this issue see Panizza (2008) and Panizza and Taddei (2020). Second, IDS do not report detailed information on the breakdown of short-term debt (debt with initial maturity below one year). Therefore, we need to make some assumption to allocate some of his debt to the public sector (details are in the notes to Table A1). Third, Horn, Reinhart, and Trebesch (2019) suggest that only part of Chinese overseas lending is reported in the IDS. If we assume that only 50% of Chinese loans are reported in the IDS, the total stock of debt of developing and emerging market countries would increase by approximately $200 million. While this is less than 4% of total debt for the whole group of developing and emerging market countries, under-reporting linked to Chinese loans could be as high as 10% of the total debt of low income countries. Finally, IDS data do not report the amounts of World Bank borrowers which are now classified as high-income (for instance, Chile).

[6]As data on roll-over needs for 2020 are not available, we follow Gourinchas and Hsieh (2020) and use 2018 as a proxy. Interest payments for 2020 (which are reported by IDS) closely track interest payments for 2018. Hence, we assume that the composition of level of debt for 2020 is similar to that of 2018.

[7] Short-term debt is classified on the basis of original maturity.

[8] Note that we do not net out Argentina’s debt which is already in default.

[9] https://www.imf.org/en/News/Articles/2020/03/27/tr032720-transcript-press-briefing-kristalina-georgieva-following-imfc-conference-call

[10] This Figure includes principal and interest due to private creditors ($252 billion in long-term debt and $508 billion of estimated short-term debt) and principal and interest due to bilateral official creditors ($43 billion). It does not include $53 billion due to the multilateral development banks which are in the process of greatly scaling up their lending to emerging and developing countries to counteract the private sector sudden stop.

[11] Communications addressed to creditors with an implicit “No RSVP Necessary” message have a long tradition in sovereign debt workouts. See Buchheit (1991). When the United Mexican States announced its moratorium on external debt payments in August of 1982 (generally thought to be the opening act in the Latin American debt crisis of the 1980s), the commercial bank lenders received a telex from Mexico asking them to roll over maturing principal amounts of their loans pending an eventual restructuring of those loans. The lenders were not asked to respond to the request. And any responses that did arrive declining the request and insisting on timely payment of maturing principal were simply ignored.

[12] The de facto seniority of amounts lent through the CCF could be further enhanced by contributing to the CCF some amount of money (it really doesn’t matter how much) from an institution like the World Bank or a multilateral development bank that enjoys a widely-recognized preferred creditor status. As long as those funds are thoroughly commingled with other amounts in the CCF, the sovereign debtor could not default on payments due under the CCF without thereby placing itself in default to a recognized preferred creditor. Such an outcome would risk alienating the affections, and the funding, of all official sector institutions. A similar “co-financing” technique was used in the Greek debt restructuring of 2012 where amounts owed to commercial creditors were contractually linked to amounts due to official European agencies such as the European Stability Mechanism. See Zettelmeyer et al. (2013). For a description of the development of the co-financing technique during the sovereign debt crises of the 1980s see Buchheit (1988). For an analysis of how debtor-in-possession financing could work in a sovereign debt context see Bolton and Skeel (2005).

[13] Article 25(1) Necessity:

Necessity may not be invoked by a State as a ground for precluding the wrongfulness of an act not in conformity with an international obligation of that State unless the act:

(a) is the only way for the State to safeguard an essential interest against a grave and imminent peril; and

(b) does not seriously impair an essential interest of the State or States towards which the obligation exists, or of the international community as a whole.

International Law Commission (2001).

[14] See Kroszner (2003) and Edwards, Longstaff, and Marin (2015) on the positive effect on debt markets of the repudiation of the gold indexation clause in debt contracts during the Great Depression.

[15]See Bolton and Rosenthal (2002) for an analysis of how ex post political intervention in debt contracts can be seen as a way of completing incomplete debt contracts.

[16]Moral hazard and the concern that the doctrine of necessity will be liberally applied to future events should be allayed by the fact that COVID-19 is a truly exogenous once-in a generation event. The latter point is supported by the following facts: (i) official forecasts point to the deepest global recession since the Great Depression; (ii) global lockdown policies which are more stringent than those adopted during World War II; (iii) unprecedented monetary and fiscal policies adopted by all advanced economies and several emerging market countries.

Appendix

Table 1: Baseline data by country groups

This table reports debt stocks, disbursements, principal repayments, and interest due by type of debt and creditor group for all developing and emerging market countries excluding China. The regional and income classification are those adopted by the World Bank (EAP: East Asia and Pacific; ECA: Emerging Europe; LAC: Latin America and the Caribbean; MNA: Middle East and North Africa; SAS: South Asia; SSA: Sub Saharan Africa; LIC: Low-income countries; LMIC: Lower-middle-income countries, UMIC: Upper-middle-income countries). The last column (G20 Action) includes all countries targeted by the debt-relief action decided by the Group of Twenty on April 16, 2020.

References

Arslanalp, Serkan and Takahiro Tsuda (2014) “Tracking Global Demand for Emerging Market Sovereign Debt,” IMF Working Paper 14/39.

Barrett, Scott (2006) “The Smallpox Eradication Game,” Public Choice 130:179–207.

Bolton, Patrick and Howard Rosenthal (2002) “Political Intervention in Debt Contracts,” Journal of Political Economy 110:1103-34.

Bolton, Patrick and David A. Skeel (2005) “Redesigning the International Lender of Last Resort,” Chicago Journal of International Law 6(1): 177-201.

Buchheit, Lee C. (1991) “Debt Restructuring-Speak: ‘¿Senor, Que Pasa?’,” International Financial Law Review, March, 10-11.

Buchheit, Lee C. (1988) “Alternative Techniques in Sovereign Debt Restructuring,” University of Illinois Law Review 1988: 371-399.

Buchheit, Lee C. and Mitu Gulati (2018) “Use of the Local Law Advantage in the Restructuring of European Sovereign Bonds,” University of Bologna Law Review 3(2): 172-179.

Sebastian Edwards, Sebastian, Francis A. Longstaff, and Alvaro Garcia Marin (2015) “The U.S. Debt Restructuring of 1933: Consequences and Lessons,” NBER Working Paper No. 21694.

Gourinchas, Pierre-Olivier and Chang-Tai Hsieh (2020) “The COVID-19 Default Time Bomb,” Project Syndicate April 9, https://www.project-syndicate.org/commentary/covid19-sovereign-default-time-bomb-by-pierreolivier-gourinchas-and-chang-tai-hsieh-2020-04

Horn, Sebastian, Carmen M. Reinhart and Christoph Trebesch (2019) “China’s Overseas Lending,” NBER Working Paper No. 26050.

International Law Commission (2001) “Responsibility of States for Internationally Wrongful Acts” https://legal.un.org/ilc/texts/instruments/english/draft_articles/9_6_2001.pdf

Kroszner, Randall (2003) “Is it Better to Forgive Than to Receive? Repudiation of the Gold Indexation Clause in Long-term Debt During the Great Depression,” Discussion Paper University of Chicago.

Landers, Clemence, Nancy Lee, and Scott Morris (2020) “More Than $1 Trillion in MDB Firepower Exists as We Approach a COVID-19 “Break the Glass” Moment,” Center for Global Development, https://www.cgdev.org/blog/more-1-trillion-mdb-firepower-exists-we-approach-covid-19-break-glass-moment

Panizza, Ugo and Filippo Taddei (2020) “Local Currency Denominated Sovereign Loans A Portfolio Approach to Tackle Moral Hazard and Provide Insurance,” IHEID Working Papers 09-2020, Economics Section, The Graduate Institute of International Studies.

Panizza, Ugo (2008). “Domestic and External Public Debt In Developing Countries,” UNCTAD Discussion Papers 188, United Nations Conference on Trade and Development.

Zettelmeyer, Jeromin, Christoph Trebesch and Mitu Gulati (2013) “The Greek Debt Restructuring: An Autopsy,” Economic Policy 28: 513-563.