It is common knowledge among economists that the most efficient instrument to mitigate climate change is a price on carbon. However, current carbon prices around the world are too low to reach global climate targets. This essay assesses the difficulties in designing successful carbon pricing reforms. It discusses how to overcome these difficulties by combining traditional public economics lessons with findings from behavioral and political science. We stress insights from public finance about the “second-best” nature of pricing carbon reforms. Further, we highlight how framing a carbon tax reform around tangible benefits can enhance political support. Finally, we explain how certain

countries were successful at introducing high carbon prices and what can be learned from these cases for making progress with climate change mitigation

Introduction

Unmitigated global climate change is projected to reduce global GDP – the most common measure of prosperity – by 23% by the end of this century (Burke et al., 2015). This is established extrapolating past economic impacts from temperature changes (when assuming future adaptation to damages from climate change resembles past adaptation). Even the difference between limiting warming to 2°C instead of 1.5°C (two possible interpretations of the 2015 Paris Agreement on climate change) could mean that global GDP is reduced by 5% in 2100 (Pretis et al., 2018). Furthermore, damages caused by rising temperatures fall disproportionally on the poor, thus not only reducing prosperity, but also increasing economic inequality (Leichenko and Silva, 2014). Unmitigated climate change would lead to a future in which the globally rich can still escape overheating, hunger and conflict, while the poor will suffer more from climate change impacts. Mitigating climate change should thus not be seen in isolation from pursuing inclusive economic prosperity, it is an integral part of it.

Economic agents emitting greenhouse gases cause climate damage, which is not reflected in the price they pay for the polluting activities. The costs of emitting greenhouse gases are externalized to third parties that do not participate in the polluting activity – markets fail to account for these costs. It is widely accepted among economists that, in order to restore efficiency in such an economy, a price on emissions should be imposed that equalises the private with the social costs of the activity. That is, a necessary condition to deliver on global climate targets is to put a price on carbon emissions (Economists’ Statement on Carbon Dividends 2019, Nordhaus, 2019; Stiglitz and Stern, 2017).

So, if the solution to this pressing global problem is as economically simple as putting a price on emissions, why has it not been done yet at a large scale? How can more ambitious emission pricing policies be introduced? Why is the scope of carbon pricing so limited, if in many countries around the world efforts to combat global warming are becoming increasingly popular? There seems to be no shortage of political proposals that address global warming, but few of them are finally implemented, and some fail to be preserved when there is a change in government.

This essay discusses insights from public economics, political and behavioral science on increasing public support for emission pricing policies. It proposes different ways of making such policies more politically popular. We focus on the role of citizens: how they are affected by national carbon pricing and what they think of it. We refrain from discussing the similarly important issue of competitiveness concerns to firms (see Aldy and Pizer, 2015; Dechezleprêtre and Sato, 2017). In particular, we argue that the way in which carbon pricing revenues are spent is important for determining whether a carbon pricing proposal will be successful. At $44 billion (in 2018) per year, revenue from global carbon pricing is sizeable and likely to increase in the mid-future. The public perception of how governments use this revenue is one of the key factors to increase support for carbon pricing.

Carbon pricing in theory and practice

The intuition behind pricing greenhouse gas emissions is straightforward: since the real cost to society is not reflected in market prices, emissions are too cheap and too much greenhouse gas is emitted. Setting a price on emissions that corrects for this, increases the price of carbon-intensive production and carbon-intensive consumption goods. As a consequence, producers are incentivized to switch to lower-emission technologies and consumers will switch to less carbon-intensive, cheaper goods. For the case of electricity, this could mean switching from fossil-fuel based technologies to renewable energies. While other greenhouse-gases, such as methane emissions, matter significantly for global warming, this essay limits the discussion to carbon emissions, the most important greenhouse gas since it makes up roughly three quarters of anthropogenic greenhouse gas emissions.

Carbon emissions can be reduced efficiently either through price or quantity instruments or their combination: carbon taxes, emission-trading systems or hybrid forms. Carbon taxes create a stable price path leaving the total amount of emissions to be determined by the economy. Knowing prices for several years to come allows firms to plan ahead and make investment decisions accordingly. Emission-trading systems, on the other hand, fix the total amount of carbon emissions by setting an ‘emission cap’, letting the market determine the price of tradable permits which entails some uncertainty about the price path. An emission trading system with a minimum or maximum price is an example of a hybrid system. All these forms of carbon pricing exist in various countries. For example, Switzerland and British Columbia have a carbon tax, the European Union and South Korea an emission-trading system and California has an emission trading system with a price corridor for permit auctions.

Putting a price on emissions is generally more efficient than other measures, such as technology standards or prohibiting certain economic activities, because a price instrument incentivizes firms to use the most cost-efficient technologies to lower emissions and so it avoids further market distortions. Additionally, pricing emissions also generates revenue, which the government can use for complementary measures such as green spending, or for the compensation of adversely affected households or firms.

However, while carbon pricing is a necessary policy instrument, additional policies are required to decarbonize the economy. For instance, underpriced carbon emissions are not the only market failure related to climate change: knowledge spillovers in technological innovation (“learning”) of new lowcarbon technologies will need to be addressed with appropriate policy instruments such as subsidies for research and development (Acemoglu et al. 2012; Fischer and Nevell 2008) or green industrial policies. Additional public interventions and investments are necessary to transform existing infrastructure, for example in the electricity and transport sectors (Guivarch and Hallegatte 2011). While the high carbon prices needed to decarbonise the economy (see below) will not significantly impact global or US economic growth (Clarke et al. 2014; Goulder et al. 2019), complementary policies would have the additional advantage to increase the response elasticity to a carbon price. Also, regulation by emission standards may be preferable for example when it cannot be assumed that the revenue will be spent progressively (Davis and Knittel, 2019; Fullerton and Muehlegger, 2019; Stiglitz, 2019).

Carbon pricing has been increasingly introduced as part of national or subnational climate policies around the world. Currently, 56 carbon pricing schemes have been implemented, covering 46 nation states; in addition, there are 28 carbon pricing initiatives at the subnational level. The Paris Agreement, the global climate agreement of 2015, relies on voluntary so called “Nationally Determined Contributions” from individual countries to achieve global emission reductions, which states must plan accordingly and report on. Within the context of these national climate plans, 96 countries have stated their intent to implement carbon pricing (World Bank Group, 2019).

The level of carbon prices greatly varies. Sweden currently has the highest carbon price in the world at US$127/tCO2 – this applies to most of the sectors not already covered under the EU emission trading system. So while carbon prices differ across sectors and are not perfect, the the country is an example that carbon pricing is working: The carbon tax was introduced in 1991. Between 1990 und 2013 the Swedish economy grew by 58% – which is several percentage points above the OECD average – while carbon emissions decreased by 23% (Andersson and Lövin, 2015). However, the carbon price under most schemes is still below the range required to reach the goals of the Paris Agreement.

The Intergovernmental Panel on Climate Change (IPCC) estimated that the appropriate global carbon price to limit warming to 2°C over pre-industrial levels is $40-$70/tCO2 in 2020, raising to $70-$105 in 2030 (Clarke et al., 2014, Ch. 6). The more recent World Bank High-Level Commission on Carbon Prices finds similar numbers to reach the temperature targets of the Paris Agreement (Stiglitz and Stern, 2017). Although more carbon pricing schemes have been introduced in recent years, their scale and ambition is completely inadequate to achieve the necessary emissions reductions. At the time of writing, approximately 20% of current global greenhouse gas emissions are covered by a carbon price and most prices are below the $40-80/tCO2 range.

The Public Finance of carbon tax reforms

Public economics analyzes carbon pricing traditionally in terms of its effects on equity and efficiency. Such analyses yield important insights regarding the exact design of a carbon pricing reform, but they are irrelevant as long as carbon pricing fails at garnering sufficient support to be implemented. Nevertheless, designing carbon pricing in the most equitable and efficient fashion is a necessity for enhancing its acceptability. Therefore, we start by summarizing three major sets of findings from public economics: theoretical results on carbon prices under distributional constraints, comparative assessments using micro data-based general equilibrium models and estimations of short term responses to carbon prices.

The first major set of findings shows how the design of carbon tax reforms is impacted by different types of constraints. For instance, in the case of a government that uses different taxes to finance a yearly budget, there might be a (weak) “double dividend” – i.e. a reduction in the overall cost of carbon pricing – if carbon pricing revenues are used to lower other taxes (Goulder, 2013). Regarding distributional constraints, it has been shown, for instance, that returning the carbon pricing revenue as equal-per-capita dividends is preferred by a government predominantly focusing on equity (Klenert and Mattauch, 2016). Real-world governments also face political and informational constraints, resistance from special interest groups and pre-existing distortionary taxes. As a consequence, economic analyses in this context will always be “second-best”, analyzing the impact of (optimal) carbon pricing reforms in a constrained environment.

An entire branch of the public finance literature is dedicated to determining optimal tax schedules – i.e. schedules that balance preferences for equality with efficiency losses from redistribution – in second best settings. Most economists consider the fact that governments cannot tax individuals on the basis of their skills, but based on second-best characteristics such as their income, as the most relevant constraint. Taking this constraint into account when determining optimal income and carbon taxes jointly, recent studies cast doubt on the double dividend hypothesis mentioned above. These studies find that using the carbon tax revenue for income tax cuts is not necessarily more efficient than equal-per-capita dividends, given that all else is optimal. A large part of the related literature centers around the question what the real cost of raising an additional unit of government revenue – the marginal cost of public funds – is for different types of taxes. The answer to this depends on many factors. For instance, Kaplow (2004) demonstrates that the marginal cost of public funds is equal to one, if Mirrleesian income taxes and the optimal supply of public goods are set simultaneously. Jacobs and de Mooij (2015) and Kaplow (2012) extend this analysis to include Pigouvian taxation and find that distributional and environmental policy can be determined separately under certain conditions. Building on this literature, Jacobs and van der Ploeg (2019) and Klenert et al., (2018b) show that this separability of distributional and environmental policy breaks down, if additional second-best constraints are added. It is doubtful whether existing tax systems are optimal. If they are not, finding ways to reduce existing inefficiencies is a highly efficient way of recycling the carbon tax revenue.

Second, a range of computational models provide quantitative assessments of different carbon pricing scenarios by using extensive micro-economic data. These models account for the fact that tax systems in the real world are not necessarily optimal. They yield three main insights: First, using the revenue for reductions in capital and corporate taxes yields the largest benefits in terms of efficiency, in the long term. Labor tax reductions perform worse in efficiency terms, but still better than directed or uniform transfers, which rank last. Second, studies disagree about which recycling mechanism performs best in the short term. Third, regarding equity, directed transfers to especially affected households perform best, uniform lump-sum transfers are still progressive but to a lesser extent, labor tax cuts can have ambivalent distributional impacts and capital/corporate tax cuts are clearly regressive (for details see Klenert et al. 2018a).[1]

Third, empirical methods and input-output-tables have been used to estimate the short-term distributional impact of carbon prices (and, in some cases, including the distributional impacts of revenue recycling). In general, a carbon price has been estimated to have a regressive effect in industrialized countries since poor households spend a larger share of their income on carbon-intensive subsistence goods (Grainger and Kolstad, 2010; Hassett et al., 2009; Poterba, 1991). However, it has also been shown that this effect can be more than offset by the recycling of the revenue (Goulder et al., 2019; Klenert and Mattauch, 2016). Most recently, Goulder et al. (2019) find that if a 40$/tCO2 carbon tax is recycled as lump-sum rebates to households, the bottom 80% of the distribution are better off and the lowest quintile of the income distribution significantly so. Similarly, a US Treasury Analysis finds that a 52$/tCO2 carbon tax would result in a 583 $ per year rebate per person in the US. This would increase adjusted family income of the poorest decile by 8.9 % and lead to a net gain up to the 7th decile of the income distribution (Horowitz et al. 2017). However, in a majority of developing countries, a carbon price has been found to be progressive, even before the recycling is considered (Dorband et al., 2019).

In sum, a carbon tax itself can be either regressive or progressive, but it can generally be made progressive through adequate revenue recycling. However, a Pareto improvement in the strict sense that every single economic actor is made better off might not be possible due to unobserved heterogeneities (Sallee, 2019). Combining lessons from large computational models and smaller conceptual models, it becomes evident that, from a strictly efficiency-focused point of view, if the initial tax system is sub-optimal, moving it closer to the optimum by reducing distortionary taxes on capital or labor is preferable. Doing this via an adjustment of labor taxes might even have an additional progressive effect (Klenert et al. 2018b). If the focus is more strongly on equity, directed and equal-per-capita transfers can make carbon tax reforms progressive.

Why carbon pricing is unpopular with some citizens and what can be done about it

Citizens perceive economic policy proposals quite differently from economists. Here we discuss insights from behavioral and political science explaining what makes citizens like or dislike carbon pricing schemes. These insights elucidate the different perceptions regarding the properties of the suggested policies, and are related to differing cultural worldviews, trust in politicians and government quality. We argue that these lessons are crucial for the successful introduction of higher carbon pricing when complemented with insights from public economics.

A number of behavioral considerations are exhibited by a nascent literature on environmental taxation and public opinion.

First, supporting climate change mitigation is largely determined by political, economic, and cultural world views. In particular, the willingness to pay for higher carbon prices varies across countries and depends on subjects’ general political preferences (Alberini et al. 2018). Notably, proposals need to avoid “solution aversion”: individuals can be more doubtful about the severity of environmental problems if the suggested policy contradicts their ideological predispositions (Campbell and Kay 2014).

Moreover, citizens tend to ignore or doubt the idea that pricing pollution reduces pollution. That is, they do not find the corrective (“Pigouvian”) effect of carbon pricing convincing, inter alia doubting that they are effective in reducing pollution (Maestre-Andrés et al., 2019). However, this intuitive doubt about the environmental effectiveness of carbon pricing may be alleviated if revenue from carbon pricing is earmarked (Kallbekken et al., 2011; Carattini et al., 2017a). This is especially true for using the proceeds on “green spending”, i.e. infrastructure overhaul or energy efficiency programs, hence partially explaining the popularity of “Green New Deal” proposals. Such proposals align with the further idea that the salience of the immediate benefits to households derived from a carbon-pricing reform bolsters public support (Atansah et al., 2017, Carattini et al., 2017b, Klenert et al., 2018a). This highlights that revenue recycling that is visible and can be perceived clearly by local communities will increase support. The reason is that the concept of a net gain by a general equilibrium effect from e.g. a labor income tax swap is too abstract to be intelligible to the general public.

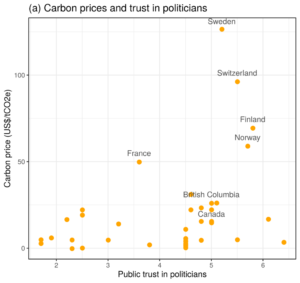

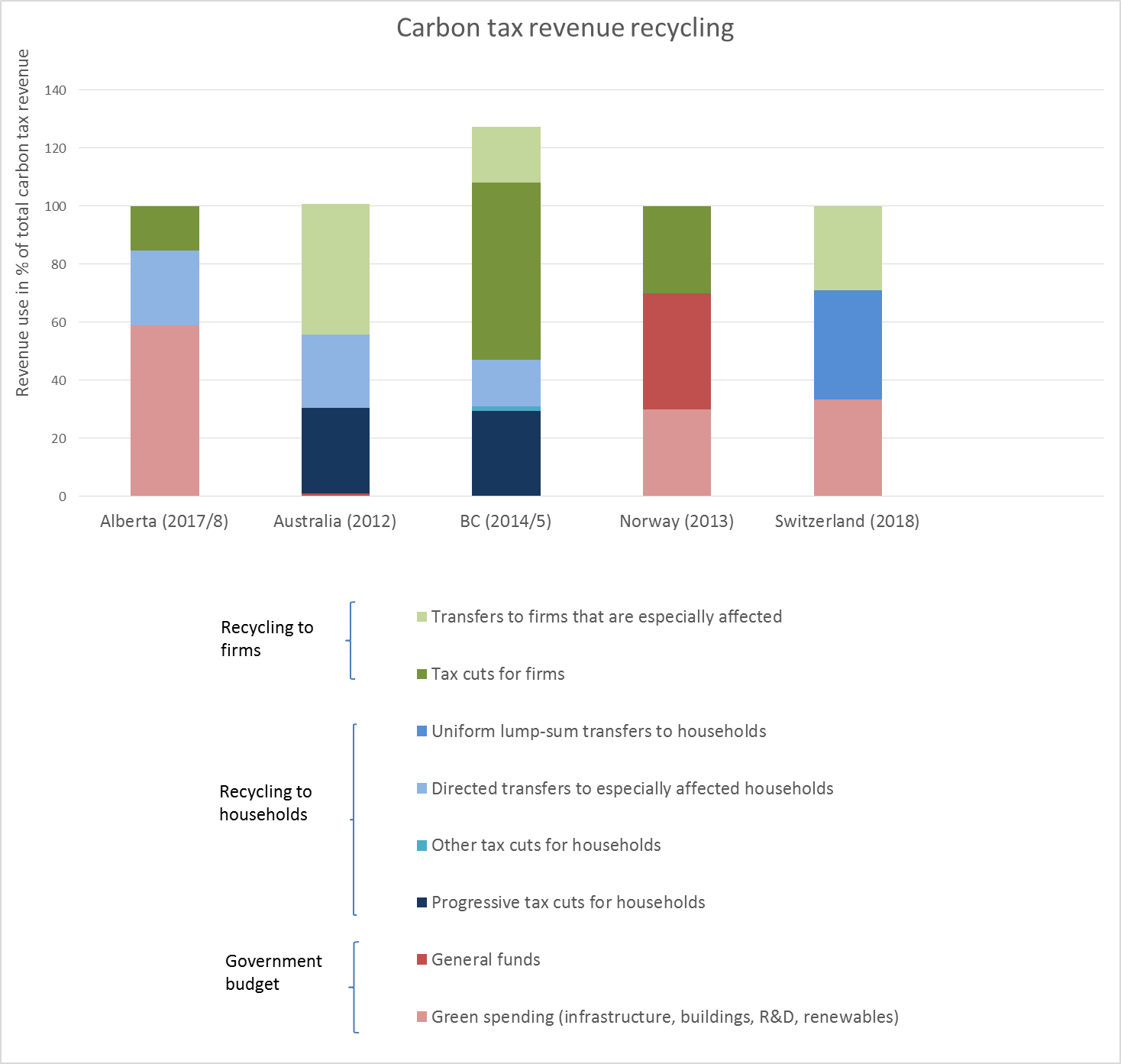

Figure 1 Panel a: Carbon prices and trust in politicians. Panel b: Carbon prices and perceived corruption

|

|

Adapted from Klenert et al. (2018a).

Sources: Transparency International (2018), World Bank Group (2019) and World Economic Forum (2018).

Furthermore, there are properties of policy instruments not recognised in public economics that matter to citizens. The name of the carbon price may influence how favourable it is perceived. Calling a carbon price a “CO2 levy”, as is the case in Switzerland, or speaking of “fee and dividend”, could circumvent solution aversion (Carattini et al., 2017a, Kallbekken et al., 2011). The reason is that the word “tax” evokes to part of the citizenry distrust of government, especially about not spending new tax money for the common good (Klenert et al., 2018a). Yet, this effect may be limited since in real campaigning the opposition will likely still call the policy a “tax”, as was for example the case in the 2018 carbon pricing proposal in Washington state (Marshall et al., 2018, Anderson et al. 2019).

This effect is tied to perhaps the most important insight from political science on carbon pricing: effective carbon pricing is correlated with high political trust and low corruption levels (see Figure 1, panel a and b). Countries with greater public distrust of politicians and perceived corruption have higher greenhouse gas emissions and weaker climate policies, as was shown in cross-national studies (Klenert et al., 2018a; Rafaty, 2018). This is exemplified by Finland, Norway, Sweden and Switzerland, which all exhibit high levels of trust and have carbon prices above 40$/tCO2. While Rafaty (2018)’s analysis does not suffice to establish a causal relationship, it shows that when corruption or trust variables are included as regressors, most other structural and political variables assumed to be important determinants of environmental policy become insignificant. France is currently an exception, as carbon prices in its’ non-EU ETS sectors are higher than the trust level would suggest (Figure 1 panel a, for further discussion see below). In settings in which trust in politicians is low, one way to introduce higher carbon prices nevertheless may be to use the revenue in a transparent manner that increases trust. Even with higher trust levels, citizens might doubt that they receive the promised payout, once the policy is introduced. Returning the revenue to citizens in advance, as is done in some Canadian provinces (Government of Canada, 2019), might mitigate this fear of political time inconsistency to some extent. Sweden’s dual fiscal reform of lower income and higher carbon taxes (Sterner 1994) may not have worked without extensive public dialogue and social deliberation.

Furthermore, the success of a policy reform is more likely if the reform features diffused costs and concentrated benefits. In the case of carbon pricing, the challenge is that benefits are diffused and costs are concentrated. Therefore, it is less likely for the scattered beneficiaries to support the policy actively in the political process than for carbon-intensive companies to oppose it. The chances of success can be enhanced if the benefits of a carbon pricing reform are targeted at constituencies that provide active support for the policy’s passage and preservation. Additionally, if carbon pricing schemes benefit constituencies across the political spectrum, they are more likely to survive successive partisan changes in government (Aklin and Urpelainen, 2013; Marsiliani and Renstrom, 2000).

Lessons from recent carbon pricing reforms across the world

Successful carbon pricing reforms have used the proceeds in line with at least some of the presented political and behavioral effects to garner public support: it is important to compensate politically pivotal constituencies, while at the same time taking account of which environmental policies citizens find intuitively plausible. In the following, we discuss selected realword examples (for more details see Klenert et al., 2018a and World Bank Group, 2019). We first focus on a number of successful well-established carbon taxes. We then discuss a number of cases where the success of the carbon tax reform is contested at the time of writing. Finally, we discuss how similar considerations are relevant for emissions trading and fossil fuel subsidy removal.

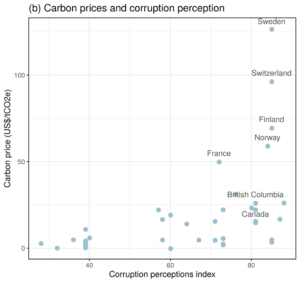

For carbon taxes, countries use mixed strategies for spending the tax proceeds to garner political support (see Figure 2 for an overview). Three examples of successful passage and preservation of a carbon tax are Sweden, Switzerland and the Canadian Province of British Columbia.

Figure 2 Revenue recycling in different carbon tax schemes

The success of Sweden in introducing a high carbon tax is due to extensive public dialogue and social deliberation. This has reinforced political trust and transparency prior to the fiscal reform that introduced carbon taxation, but cut other taxes. In Switzerland, besides an emissions trading system for the power sector and some industry, there exists also a CO2 levy (mostly on heating fuels). Of the tax proceeds from that levy, one-third is used for green spending and the remaining two-thirds are returned to the general public and the private sector. To increase the salience, the Swiss government allocates a substantial share of revenues to households as uniform dividends. In the Canadian province of British Columbia, where all carbon tax revenues go to households and firms, strong constituencies have been created in favor of carbon pricing. The center-right government, backed by both an environmentally aware electorate base and the business community was able to design a carbon tax reform that enjoys broad political acceptance.

At the time of writing, a number of carbon tax reforms around the world are contested or failed. We focus in this essay on the most recent cases of prominent carbon tax reforms: we draw lessons from recent reforms and proposals in Canada, Australia and Washington State, where entrenched partisanship about climate issues is a major factor, France, where lack of political trust seems a major obstacle, and South Africa, the first African country to implement carbon pricing.

In April 2019, the Canadian government imposed a carbon tax of 20 C$/tCO2 on provinces that did not have a carbon price at that time (Dobson et al., 2019). Even though 90% of the revenue is returned to households on a per-capita basis and the policy is projected to be progressive, it faces fierce resistance from right-leaning parties and might be abolished after the elections in October 2019 (Government of Canada, 2019 and The Guardian, 2019). This suggests that carbon pricing is perceived as an issue of political partisanship. For similar reasons, Alberta’s carbon tax has been repealed on May 30 2019. Previously, the revenues of Alberta’s so-called ‘carbon levy’ had been split between green spending and compensation for those who were disproportionately affected by carbon pricing.

The Australian carbon pricing scheme provides another cautionary tale. Introduced in 2012, the recycling strategy was designed in accordance with economics textbooks’ recommendations. The carbon price was abolished in 2014, however, which demonstrates that a carbon price design that meets equity and efficiency goals alone is not sufficient. Factors of political communication are of crucial importance. Since then, climate policy has been a highly divisive topic in Australian politics and there is little hope of a carbon pricing scheme reemerging anytime soon.

The US State of Washington recently saw two ballots for introducing a carbon tax. Both these ballots, held in 2016 and 2018 were defeated, by 60 and 56% of the vote respectively. The first proposal would have been a revenue-neutral design, using tax proceeds mostly for reducing sales taxes and matching the federal Earned Income Tax Credit i.e. increasing labor income for families. The second proposal would have had a lower price signal, but used the tax proceeds entirely for green spending. The first proposed design was an attempt at bipartisan appeal, including orthodox economic principles and with a view to keeping government out of the workings as much as possible, the second attempt was designed to a united (hypothesized) left majority in the State and called a “fee”. As both very different attempts at design and communication have failed, it is an open question, which design will work in the current US political climate (Anderson et al., 2019, Roberts, 2018). Anderson et al. (2019) in particular highlight that an electoral campaign can lower public support for a carbon tax, even if it was initially popular. Emissions trading may be a more promising instrument choice, see below.

Current developments regarding the carbon price in France demonstrate the difficulty of sustaining ambitious carbon pricing when trust in politicians is low (see also Figure 1, panel a). The French government, after a series of failed attempts, introduced a carbon price of 7€/tCO2 in 2014 and gradually increased it to 44.6€/tCO2 in 2018. The next step would have been an increase to 65.4 €/ tCO2 in 2020 and further increases were planned, but president Macron froze the carbon tax at its current level in response to violent demonstrations of the so called “Yellow Vest” protesters. The protests were sparked in late 2018 by high gasoline prices. These price increases were perceived as unfair, since the French government just had significantly reduced wealth taxes, and directed only less than one fourth of the carbon pricing revenue towards direct compensatory measures for poor households (Rubin and Sengupta, 2018).[2] In fact, Douenne (2018) finds that, without compensatory measures, the tax itself has a regressive effect, but even with progressive revenue-recycling there are still further heterogenities at the same income level that are unaddressed. Previous increases had not sparked any protests. This suggests that French citizens do not oppose higher carbon prices per se, but demand a fair and inclusive implementation. However, Douenne and Fabre (2019) find that French cititzens’ overestimate the negative impact on their purchasing power, think it is regressive even with a lump-sum rebate and do not perceive it as environmentally effective.

Carbon pricing is by no means advancing in Western nations only. South Africa is the first country in Africa to have introduced a carbon price in June 2019 after many years of preparation and political debate. As the tax rate is low, it is currently not earmarked, but there have been calls to spend it in a way salient to the poor to provide them with cleaner and safer energy (Winkler and Marquard, 2019). In Latin America, several countries have already established carbon taxes, however at low levels. Both Colombia and Mexico are also in the process of implementing emissions trading systems with revenue allocated towards green spending (World Bank Group, 2019).

Third, emissions trading systems (ETS) and fossil fuel subsidy reforms (fossil fuel subsidies being essentially a negative price on carbon) are two other instruments employed in the real-world to which the above considerations are relevant. We treat them briefly here, for further details see Klenert et al. (2018a) and Narassimhan et al. (2018).

In contrast to the carbon tax schemes discussed, in ETS the revenues —including those in the European Union and South Korea as well as the subnational systems in the United States and Canada — have typically not been used in ways salient to tax payers. In most ETS, the largest part of the gross revenue is handed out to firms via free emissions permits (ca 60% in the EU ETS in 2013, 90% in South Korea). This is perhaps no surprise because as it is mainly firms that participate, a great amount of political effort has been put towards granting exemptions or allowances to energy-intensive, tradeexposed firms. It is possible that this may in the future be perceived as unfair by citizens (Maestre-Andrés et al., 2019). It may also be that the workings of emissions trading are opaque to citizens.

Recent initiatives to remove fossil fuel subsidies in India, Iran and Nigeria provide important insights on how such policies can be made acceptable to citizens. As fossil fuel subsidies often favor medium- to highincome households in developing countries (in Nigeria, for example) their removal is often progressive. However, this does not mean that poor households are better off in absolute terms. India and Iran provide good examples for successful fossil fuel subsidy reforms. Two main measures were employed to ensure the salience of the reforms’ benefits: first, transparent and abundant information regarding the reform and the increasing access to banking and identification services was provided by the government; second, low- and middleincome households were compensated through uniform lump-sum transfers. In Iran, these transfers amounted to 28% of median per-capita expenditures of a family of four in 2011, and lifted millions of households out of poverty (Atansah et al., 2017).

This last point reinforces a basic argument regarding important non-climate benefits of higher carbon prices in poor countries: missing government revenue for building basic infrastructure to combat poverty. Franks et al. (2018) find that in India and Egypt, removing fossil fuel subsidies and pricing carbon suffices to satisfy the financing needs for achieving the Sustainable Development Goals, although that is not the case in sub-Saharan Africa. Similarly, Jakob et al. (2015) find that for the majority of countries, phasing out fossil fuel subsidies would yield enough funds to finance universal access to water, sanitation, and electricity. In economies with large informal sectors, a price on carbon is more difficult to evade than labor or income taxes, so that a tax on carbon in some cases almost “pays for itself” – in the sense that the positive growth effects of increased government spending by a previously underfunded government outweigh potential detrimental effects of the carbon tax – akin to a strong double dividend (Liu, 2013). Even in the US, this effect might decrease costs for energy taxes by half (Bento et al., 2018) and more so in poorer countries. Communicating these co-benefits to citizens in a clear and accessible way might make it much easier for governments to successfully implement a carbon pricing reform (Marshall et al., 2018).

Policy implications

It has been said that the perfect is the enemy of the good. Given the urgent need to deliver on global climate targets, our research shows that a theoretically beautiful carbon pricing scheme may not resonate as well with the public as a scheme that takes into account the public’s concerns about fairness, salience of the benefits and citizen’s distrust in government. If the most important aim of a policy proposal for higher carbon prices is to maximise its chance of passage and preservation in the political process, a set of considerations is important beyond efficiency losses and competitiveness concerns. As citizens are concerned about individual losses, it is important to design carbon pricing schemes in a way that citizens feel they are getting some immediate benefits.

In effect, using the proceeds from carbon pricing revenues as lump-sum dividends is generally a commendable strategy: Equal per capital transfers are salient if paid out as checks, they can create constituents in favor of climate policy and could also be advantageous in political contexts in which solution aversion or lack of political trust are the dominating factors. However, there is no single best solution for all contexts, but rather advice on revenue-recycling needs to account for local circumstances: For some countries, salient infrastructure investment, similar to “Green New Deal” proposals, and transfers to especially affected households could be a more successful strategy than lump-sum transfers. Importantly, our research into carbon pricing across the world shows that successful carbon pricing reforms followed the lessons on behavioral and political science about strategic revenue recycling to garner political support, rather than those from public finance theory. However, in those cases in which public support for higher carbon prices is already large, traditional lessons from public finance theory on tax reform can be applied more straightforwardly.

Within the overarching framework of inclusive prosperity, carbon pricing is not only key to ensuring future economic growth and to prevent increasing inequality through climate damages, it also is an important lever to reduce poverty directly in developing country contexts. Additional government revenue from carbon pricing – often easier to collect than income tax revenue due to large informal sectors in poor countries – could substantially contribute to close the gap in financing basic infrastructure needs vital to achieve the Sustainable Development Goals.

Endnotes

[1]Some studies have also analyzed non-fiscally neutral ways to recycle the carbon pricing revenue, for instance, for public deficit reduction (Carbone et al., 2013) or pension funding (Rausch and Reilly, 2015).

[2]An additional factor concerns government communication and the role social networks and news reporting plays. The protests have been augmented by “fake news” regarding the carbon tax that rapidly spread over social networks (Liberation, 2018). This might have been avoided at least to some extent by clear and abundant government communication on the real costs and benefits of the carbon tax.

References

Acemoglu, D., Aghion, P., Bursztyn, L., & Hemous, D. (2012). The environment and directed technical change. American Economic Review, 102(1), 131-66.

Aklin, M. & Urpelainen, J. (2013). Political competition, path dependence, and the strategy of sustainable energy transitions. American Journal of Political Science, 57, 643–658.

Alberini, A., Bigano, A., Ščasný, M., & Zvěřinová, I. (2018). Preferences for energy efficiency vs. renewables: what is the willingness to pay to reduce CO2 emissions? Ecological Economics, 144, 171-185.

Anderson, Soren and Marinescu, Ioana Elena and Shor, B. (2019) Can Pigou at the Polls Stop US Melting the Poles? Working Paper. Available at http://dx.doi.org/10.2139/ssrn.3400772

Andersson and Lövin 2015. Sweden: Decoupling GDP growth from CO2 emissions is possible. Carbon Pricing Leadership Coalition 2015. Retrieved from: https://www.carbonpricingleadership.org/news/2015/5/24/swedendecoupling-gdp-growth-from-co2-emissions-is-possible [date: 19-07-19].

Atansah, P.,Khandan, M., Moss, T., Mukherjee, A.,Richmond, J. (2017). When Do Subsidy Reforms Stick? Lessons from Iran, Nigeria, and India. CGD Policy Paper. Washington, DC: Center for Global Development.

Aldy, J. E. & Pizer, W. A (2015). The competitiveness impacts of climate change mitigation policies. Journal of the Association of Environmental and Resource Economists. 2, 565–595.

Bento, A. M., Jacobsen, M. R., & Liu, A. A. (2018). Environmental policy in the presence of an informal sector. Journal of Environmental Economics and Management, 90, 61-77.

Burke, M., Hsiang, S. M., & Miguel, E. (2015). Global non-linear effect of temperature on economic production. Nature, 527(7577), 235.

Campbell, T. H., & Kay, A. C. (2014). Solution aversion: On the relation between ideology and motivated disbelief. Journal of personality and social psychology, 107(5), 809.

Carattini, S., Baranzini, A., Thalmann, P., Varone, F., & Vöhringer, F. (2017a). Green taxes in a post-Paris world: are millions of nays inevitable?. Environmental and Resource Economics, 68(1), 97-128.

Carattini, S., Carvalho, M., & Fankhauser, S. (2017b). How to make carbon taxes more acceptable. London: Grantham Research Institute on Climate Change and the Environment, and Centre for Climate Change Economics and Policy, London School of Economics and Political Science.

Carbone, J. C., Morgenstern, R. D., Williams R. III & Burtraw, D. Deficit Reduction and Carbon Taxes: Budgetary, Economic, and Distributional Impacts (Resources for the Future, 2013).

Clarke L., K. Jiang, K. Akimoto, M. Babiker, G. Blanford, K. Fisher-Vanden, J.-C. Hourcade, V. Krey, E. Kriegler, A. Löschel, D. McCollum, S. Paltsev, S. Rose, P. R. Shukla, M. Tavoni, B. C. C. van der Zwaan and & D.P. van Vuuren (2014). Assessing Transformation Pathways. In: Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J.C. Minx (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

Davis, L.W. and Christopher R. Knittel, “Are Fuel Economy Standards Regressive?,” Journal of the Association of Environmental and Resource Economists 6, no. S1 (March 2019): S37-S63.

Dechezleprêtre, A., & Sato, M. (2017). The impacts of environmental regulations on competitiveness. Review of Environmental Economics and Policy, 11(2), 183-206.

Dobson, Sarah & Winter, Jennifer & Boyd, Brendan. (2019). The Greenhouse Gas Emissions Coverage of Carbon Pricing Instruments for Canadian Provinces. The School of Public Policy Publications. 12. 10.11575/sppp. v12i0.53155.

Dorband, I. I., Jakob, M., Kalkuhl, M., & Steckel, J. C. (2019). Poverty and distributional effects of carbon pricing in low-and middle-income countries–A global comparative analysis. World Development, 115, 246-257.

Douenne, T. (2018). The vertical and horizontal distributive effects of energy taxes: A case study of a French policy. FAERE Working Paper, 2018.10.

Douenne, T., Fabre, A. (2019). Can We Reconcile French People with the Carbon Tax? Disentangling Beliefs from Preferences. FAERE Working Paper, 2019.10.

Economists’ Statement on Carbon Dividends (2019). Retrieved from https://www.econstatement.org/ on 15 July 2019.

Fischer, C., Newell, R. G. (2008). Environmental and technology policies for climate mitigation. Journal of Environmental Economics and Management, 55(2), 142-162.

Franks, M., Lessmann, K., Jakob, M., Steckel, J. C., & Edenhofer, O. (2018). Mobilizing domestic resources for the Agenda 2030 via carbon pricing. Nature Sustainability, 1(7), 350.

Fullerton, D. and Erich Muehlegger, Who Bears the Economic Burdens of Environmental Regulations?, Review of Environmental Economics and Policy, Volume 13, Issue 1, Winter 2019, Pages 62–82, https://doi.org/10.1093/ reep/rey023

Goulder, L. H. Climate change policy’s interactions with the tax system. Energy Economics. 40, S3–S11 (2013).

Goulder, L. H., Hafstead, M. A., Kim, G., & Long, X. (2019). Impacts of a carbon tax across US household income groups: What are the equity-efficiency trade-offs?. Journal of Public Economics, 175, 44-64.

Guivarch, C., & Hallegatte, S. (2011). Existing infrastructure and the 2 C target. Climatic Change, 109(3-4), 801-805.

Government of Canada (2019) Pricing Pollution: how it will work. Retrieved from: https://www.canada.ca/en/ environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work.html

Grainger CA, Kolstad CD (2010) Who pays a price on carbon? Environmental and Resource Economics 46(3):359– 376.

Hassett, K., A. & Mathur, A. & Metcalf, G.E., 2009. “The Incidence of a U.S. Carbon Tax: A Lifetime and Regional Analysis,” The Energy Journal, International Association for Energy Economics, vol. 30(2), 155-178.

Horowitz, J., Cronin, J.-A., Hawkins, H., Konda, L., Yuskavag, A. (2017). Methodology for Analyzing a Carbon Tax. The Department of the Treasury. Office of Tax Analysis Working Paper 115.

Jacobs B, De Mooij RA (2015) Pigou meets Mirrlees: on the irrelevance of tax distortions for the second-best Pigouvian tax. Journal of Environmental Economics and Management 71:90–108.

Jacobs, B., and Rick van der Ploeg (2019), “Redistribution and Pollution Taxes with Non-linear Engel Curves”, Journal of Environmental Economics and Management, 95, 198-226.

Jakob, M., Chen, C., Fuss, S., Marxen, A., & Edenhofer, O. (2015). Development incentives for fossil fuel subsidy reform. Nature Climate Change, 5(8), 709.

Kallbekken, S., Kroll, S., & Cherry, T. L. (2011). Do you not like Pigou, or do you not understand him? Tax aversion and revenue recycling in the lab. Journal of Environmental Economics and Management, 62(1), 53-64.

Kaplow L (2004) On the (ir)relevance of distribution and labor supply distortion to government policy. Journal of Economic Perspectives 18(4):159–175.

Kaplow L (2012) Optimal control of externalities in the presence of income taxation. International Economic Review 53(2):487–509.

Klenert, D., & Mattauch, L. (2016). How to make a carbon tax reform progressive: The role of subsistence consumption. Economics Letters, 138, 100-103.

Klenert, D., Mattauch, L., Combet, E., Edenhofer, O., Hepburn, C., Rafaty, R., & Stern, N. (2018a). Making carbon pricing work for citizens. Nature Climate Change, 8(8), 669-77.

Klenert, D., Schwerhoff, G., Edenhofer, O. & Mattauch L., Environmental and Resource Economics (2018b) 71(3): 605-624. https://doi.org/10.1007/s10640-016-0070-y

Leichenko, R. and Silva, J. A. (2014). Climate change and poverty: vulnerability, impacts, and alleviation strategies. Wiley Interdisciplinary Reviews: Climate Change, 5(4):539-556.

Liberation 2018. Prix du carburant : huit «fake news» qui circulent sur le mouvement du 17 novembre. Retrieved from: https://www.liberation.fr/checknews/2018/11/04/prix-du-carburant-huit-fake-news-qui-circulent-sur-lemouvement-du-17-novembre_1689824

Liu, A. A. (2013). Tax evasion and optimal environmental taxes. Journal of Environmental Economics and Management, 66(3), 656-670.

Maestre-Andrés, S., Stefan Drews & Jeroen van den Bergh (2019) Perceived fairness and public acceptability of carbon pricing: a review of the literature, Climate Policy, DOI: 10.1080/14693062.2019.1639490

Marshall, George; Conway, Darragh; Webster, Robin; Comeau, Louise; Besley, Daniel James; Saldarriaga Arango, Isabel (2018). Guide to Communicating Carbon Pricing (English). Washington, D.C. : World Bank Group. http:// documents.worldbank.org/curated/en/668481543351717355/Guide-to-Communicating-Carbon-Pricing

Marsiliani, L. & Renstrom, T. I. (2000) Time inconsistency in environmental policy: Tax earmarking as a commitment solution. The Economic Journal 110, C123–C138.

Narassimhan, E., Kelly S. Gallagher, Stefan Koester & Julio Rivera Alejo (2018) Carbon pricing in practice: a review of existing emissions trading systems, Climate Policy, 18:8, 967-991, DOI: 10.1080/14693062.2018.1467827

Nordhaus, W. (2019). Climate change: The ultimate challenge for Economics. American Economic Review, 109(6), 1991-2014.

Poterba, J (1991), Is the gasoline tax regressive?, Tax Policy and the Economy 5: 145–164.

Pretis, F., Schwarz, M., Tang, K., Haustein, K., & Allen, M. R. (2018). Uncertain impacts on economic growth when stabilizing global temperatures at 1.5 C or 2 C warming. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 376(2119), 20160460.

Rafaty, R. (2018). Perceptions of Corruption, Political Distrust, and the Weakening of Climate Policy. Global Environmental Politics, 18(3), pp. 106-129.

Rausch, S. & Reilly, J. Carbon taxes, deficits, and energy policy interactions. National Tax Journal 68, 157–178 (2015).

Roberts, D. (2018). Washington votes no on a carbon tax – again. Vox. Retrieved from https://www.vox.com/energyand-environment/2018/9/28/17899804/washington-1631-results-carbon-fee-green-new-deal [accessed: 15-7-2019].

Rubin, A.J. and Sengupta, S. (2018). ‘Yellow Vest’ Protests Shake France. Here’s the Lesson for Climate Change. New York Times. Retrieved from: https://www.nytimes.com/2018/12/06/world/europe/france-fuel-carbon-tax.html

Sallee, J.M. (2019). Pigou Creates Losers: On the Implausibility of Achieving Pareto Improvements from Efficiency Enhancing Policies. NBER Working Paper. 25831.

Sterner, T. (1994). Environmental tax reform: the Swedish experience. European Environment, 4(6), 20-25.

Stiglitz, J. E., Stern, N (2017). Report of the High-Level Commission on Carbon Prices (World Bank, 2017).

Stiglitz, J. E. (2019). Addressing Climate Change through Price and Non-Price Interventions. European Economic Review, in press. https://doi.org/10.1016/j.euroecorev.2019.05.007

SVR (2019). Aufbruch zu einer neuen Klimapolitik [Departure to a new climate policy]. Special report of the Council of Economic Advisors of the German Government. July 2019. Retrieved from: https://www.sachverstaendigenratwirtschaft.de/fileadmin/dateiablage/gutachten/sg2019/sg_2019.pdf

The Guardian (2019). ‘It’s no longer free to pollute’: Canada imposes carbon tax on four provinces. Retrieved from: https://www.theguardian.com/world/2019/apr/01/canada-carbon-tax-climate-change-provinces [retrieved: 19-07-19].

Transparency International (2019) Corruption Perceptions Index 2018. Retrieved from: https://www.transparency.org/cpi2018

Winkler, H. and Marquard, A. (2019). Carbon tax revenues could be harnessed to help South Africa’s poor. The conversation retrieved from: https://theconversation.com/carbon-tax-revenues-could-be-harnessed-to-helpsouth-africas-poor-117847 [accessed: 19-07-21].

World Bank Group (2019). State and Trends of Carbon Pricing 2019 (June). World Bank, Washington, DC. DOI: 10.1596/978-1-4648-1435-8. License: Creative Commons Attribution CC BY 3.0 IGO.

World Economic Forum (2018) The Global Competitiveness Report 2017-18.